Having a new driver in your family can be a nerve-wracking experience. As a parent, your mind somehow jumps to all of the things that can possibly go wrong, and how your newly-permitted driver is yet unequipped to handle different situations in a car. Teaching your teen to drive takes patience and the ability to be objective – you need to provide guidance instead of criticism. We hope the following five tips will help you as you wind your way through these sometimes stressful moments!

Having a new driver in your family can be a nerve-wracking experience. As a parent, your mind somehow jumps to all of the things that can possibly go wrong, and how your newly-permitted driver is yet unequipped to handle different situations in a car. Teaching your teen to drive takes patience and the ability to be objective – you need to provide guidance instead of criticism. We hope the following five tips will help you as you wind your way through these sometimes stressful moments!

Stay Calm

No matter what happens, it is important to remain calm. Yes, grab the uh-oh handle and step on the imaginary brake pedal on the passenger side of the car if you must, but take a deep breath and remain calm. Dealing with situations on the road are stressful enough for a new driver and losing your cool won’t help. If you need to calm yourself, find a good place to pull over and take a walk around the car until you are ready to continue.

Talking to Your Teen Respectfully (i.e. Don’t Yell – Ever)

Instead of saying “You need to slow down more around corners”, maybe go with something along the lines of “How do you feel you handled that last turn?”. Your job as a driving instructor is different from that of a parent. Your job is to get them to think for themselves about what they are doing and how to make adjustments to stay safe on the roads. Be respectful and make them think.

Allowing Them to Learn in a Multitude of Situations

Yes, it is snowing and the roads may be slick. It’s dark and foggy and the visibility is poor. It’s pouring rain out and the windshield wipers are a bit wonky on the car. It’s rush hour and there’s a lot of traffic on the highway. There’s always a good excuse to opt to not allow your teen to drive, but dealing with these situations will help to make them better drivers. Knowing how to handle a snowy roadway or a busy highway is important and the only way for them to learn to navigate these situations well is by giving them the opportunity to practice. It may not be the most comfortable experience for you, but it is important for them.

Know the Rules of the Road

If you passed your test 30 years ago, you should definitely take a look through the manual as a refresher. Knowing the rules of the road will be part of the drivers test and if you aren’t familiar with the rules (some things may be different), you can’t adequately guide your teenager – and you may even mislead them into thinking that something they are doing is okay when it is not.

It’s Not About How to Operate a Car

Driver education is not about how the car works. Things like how to change a tire or checking the fluid levels, tire pressure, etc. are important to know, but it’s a different part of the new driver training. Every car is a little bit different in where things are, how they handle, etc., but it’s also mostly the same. Operating a vehicle and driving safely are two different things.

Focus on the Main Things:

The four main items to spend your time on are speed, space, observation and communication. If you can get your teen to be thinking of these whenever they get behind the wheel, you will be well on your way to training a safe driver. If they can master these four things during their training, then you have done your job.

Extra Bonus Insurance Tip: A teen or young adult with a learner’s permit in New York State accompanied by a licensed adult supervisor does not need to have their own insurance policy. Once they become a licensed driver, they should be added to your policy or you can consider getting them their own insurance.

If you have any insurance-related questions, please feel free to contact our team at Bieritz Insurance – 209 Main Street in Cooperstown (607-547-02951) or at Morris Insurance, 128 Main Street in Morris (607-263-5170).

Travel insurance is insurance that is intended to cover medical expenses, trip cancellation, lost luggage, flight accident and other losses incurred while traveling, either internationally or domestically. (

Travel insurance is insurance that is intended to cover medical expenses, trip cancellation, lost luggage, flight accident and other losses incurred while traveling, either internationally or domestically. (

Every old house homeowner knows there are time of the year when they find some unexpected house guests. When the weather warms in the spring and summer months, the small trails of ants might appear in your kitchen, and in the fall months, as the weather cools, there are sometimes little creepers that find their way into your pantry.

Every old house homeowner knows there are time of the year when they find some unexpected house guests. When the weather warms in the spring and summer months, the small trails of ants might appear in your kitchen, and in the fall months, as the weather cools, there are sometimes little creepers that find their way into your pantry. Most of the summer months are dedicated to storm season. In between the days that are perfect for the beach, with blue and yellow skies, are days full of heavy rain, winds, and flooding, with the occasional–for Upstate New York–hailstorm, tornado, and hurricane. These weather conditions, in combination with increased vacationing travel, road work, and presence of motorcycles and bikes on the roads, contribute to a higher average of fatal accidents taking place in the summer rather than the winter. At times like these, we find ourselves wanting to know how we can maximize driving safety. Below, you will find a list of summertime storm hazards, and ways you can alter your driving to better ensure safety in each of them.

Most of the summer months are dedicated to storm season. In between the days that are perfect for the beach, with blue and yellow skies, are days full of heavy rain, winds, and flooding, with the occasional–for Upstate New York–hailstorm, tornado, and hurricane. These weather conditions, in combination with increased vacationing travel, road work, and presence of motorcycles and bikes on the roads, contribute to a higher average of fatal accidents taking place in the summer rather than the winter. At times like these, we find ourselves wanting to know how we can maximize driving safety. Below, you will find a list of summertime storm hazards, and ways you can alter your driving to better ensure safety in each of them. One of the small joys of the summer season for adults and children alike is being able to go swimming. Cooling off in the water offers relief from the heat and humidity. If you are looking for the convenience and benefits of having your own backyard pool, don’t forget to consider the added cost of insurance into your expenses.

One of the small joys of the summer season for adults and children alike is being able to go swimming. Cooling off in the water offers relief from the heat and humidity. If you are looking for the convenience and benefits of having your own backyard pool, don’t forget to consider the added cost of insurance into your expenses.  Unfortunately, leaving home for long periods of time is a risk – there are some who may be looking out for a temporarily empty nest to encroach upon, or a technical time-bomb could erupt. Both could leave you disadvantaged in various ways, depending on your homeowners policy, and both could also reverse the intended effects of vacationing.

Unfortunately, leaving home for long periods of time is a risk – there are some who may be looking out for a temporarily empty nest to encroach upon, or a technical time-bomb could erupt. Both could leave you disadvantaged in various ways, depending on your homeowners policy, and both could also reverse the intended effects of vacationing.  We understand that, with summer right around the corner and water temperatures sure to be rising, you want to get back out on that water fast. While the draws of Glimmerglass and other bodies of water are many, your safety is nothing to be hasty about, and so here we provide 5 things to consider when buying boat insurance.

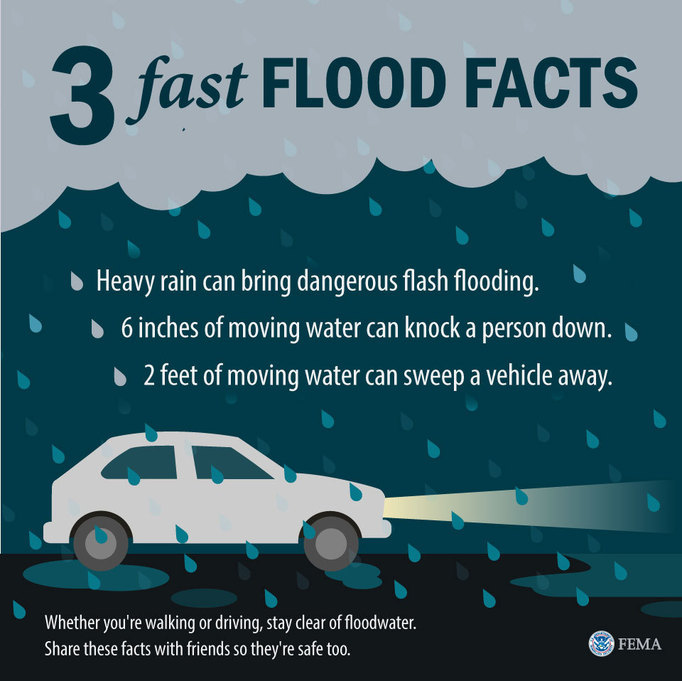

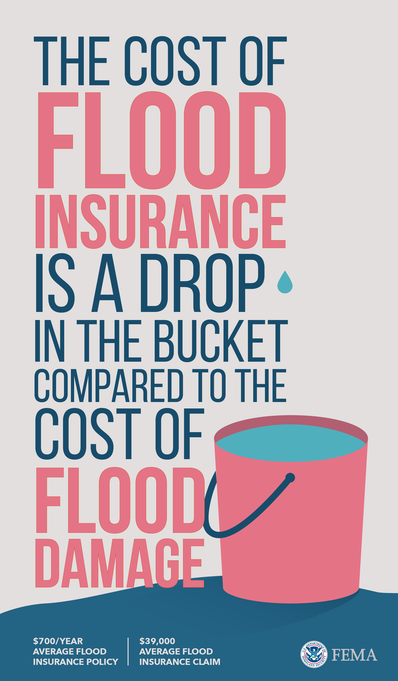

We understand that, with summer right around the corner and water temperatures sure to be rising, you want to get back out on that water fast. While the draws of Glimmerglass and other bodies of water are many, your safety is nothing to be hasty about, and so here we provide 5 things to consider when buying boat insurance.  Spring is here and with the season’s change comes the rain. It seems that we have had a good deal of precipitation just over the last two weeks in our region – and if you are looking at our local rivers and streams, we are noticing that the water is running fast and high. Floods happen everywhere – they are not relegated to specific regions like tornadoes or hurricanes. Our area has certainly had more than a few years over this last decade where flooding has been severe. For safety, please keep an ear out for warnings and follow the safety suggestions below!

Spring is here and with the season’s change comes the rain. It seems that we have had a good deal of precipitation just over the last two weeks in our region – and if you are looking at our local rivers and streams, we are noticing that the water is running fast and high. Floods happen everywhere – they are not relegated to specific regions like tornadoes or hurricanes. Our area has certainly had more than a few years over this last decade where flooding has been severe. For safety, please keep an ear out for warnings and follow the safety suggestions below!

Knowing when and when not to file an insurance claim is one of the tricks of the trade for someone trying to manage the costs of damage to one’s property or house. Every insurance agency has different regulations for what makes a valid claim, as well as for what policy modifications are necessary after a claim has been made. Often, insurance rates are raised. Based on the circumstances of the claim and of a homeowner’s claim history, policies can even be cancelled and a client can earn a reputation in the field that makes other providers refuse them or offer unaffordable policies. Therefore, it is helpful to know generally when and when NOT to file a claim for property damage.

Knowing when and when not to file an insurance claim is one of the tricks of the trade for someone trying to manage the costs of damage to one’s property or house. Every insurance agency has different regulations for what makes a valid claim, as well as for what policy modifications are necessary after a claim has been made. Often, insurance rates are raised. Based on the circumstances of the claim and of a homeowner’s claim history, policies can even be cancelled and a client can earn a reputation in the field that makes other providers refuse them or offer unaffordable policies. Therefore, it is helpful to know generally when and when NOT to file a claim for property damage.  Snowmobiling is

Snowmobiling is  Stock your car with…

Stock your car with…

The Fall Season has officially arrived in our area with the first frost (last night) and the cooler temperatures means that it’s time to start using our fireplaces and wood-burning stoves to help warm a room or to take a bit of the chill out of the air. Before you begin to use these, however, it is recommended to inspect and clean them to make sure they are safe to operate. According to the National Fire Protection Association, this should be done at least once a year, usually in the fall months.

The Fall Season has officially arrived in our area with the first frost (last night) and the cooler temperatures means that it’s time to start using our fireplaces and wood-burning stoves to help warm a room or to take a bit of the chill out of the air. Before you begin to use these, however, it is recommended to inspect and clean them to make sure they are safe to operate. According to the National Fire Protection Association, this should be done at least once a year, usually in the fall months. In addition to annual maintenance, we encourage our families, friends, and clients to always use safe fireplace practices:

In addition to annual maintenance, we encourage our families, friends, and clients to always use safe fireplace practices: Just because you have an older home doesn’t mean you can’t make it into a smart home. Many new home constructions are integrating smart home technologies into design, but even if you have an older home, there are systems you can implement in your home to manage systems that address security, locks, lighting, and heating/cooling. Making your home a “smart home” can help save energy, time and expense and you might be surprised to find that installing some of these smart features can be affordable and can be done yourself!

Just because you have an older home doesn’t mean you can’t make it into a smart home. Many new home constructions are integrating smart home technologies into design, but even if you have an older home, there are systems you can implement in your home to manage systems that address security, locks, lighting, and heating/cooling. Making your home a “smart home” can help save energy, time and expense and you might be surprised to find that installing some of these smart features can be affordable and can be done yourself! August is typically the hottest month of the year here in the Central New York region, and perhaps the only month that we struggle with trying to keep our homes a bit cooler. In many cases it doesn’t make sense to install air conditioning for the short period of time that it might be needed. Considering the small window of time that they are used, air conditioners can significantly increase your electricity costs. If you find yourself on a budget but still needing to make your home more comfortable during the heat of the season, these ideas may be helpful to you!

August is typically the hottest month of the year here in the Central New York region, and perhaps the only month that we struggle with trying to keep our homes a bit cooler. In many cases it doesn’t make sense to install air conditioning for the short period of time that it might be needed. Considering the small window of time that they are used, air conditioners can significantly increase your electricity costs. If you find yourself on a budget but still needing to make your home more comfortable during the heat of the season, these ideas may be helpful to you!