The fall months present a great opportunity for home projects that can help you prevent incidents over the winter season. In addition to accident and damage prevention, some of these can save you some money on energy costs as well! Here are a few tips to help you get your home ready for the winter.

-

Common Home Air Leak Areas Survey your property for dead tree limbs and remove them before they fall during a storm. Taking down dead and dying tree limbs can prevent damage to your home and power lines. Make sure you take safety precautions or hire a local professional to help you with this.

-

Check your plumbing. Are there water pipes in your home that are susceptible to freezing over the winter months? You can insulate your pipes with pre-slit pipe foam (available at most hardware and home repair stores). Just cut pieces to the proper length for exposed pipes and use duct tape to secure them. You can also insulate your water heater too!

-

Inspect and clean your chimney. As we move into the fall months, you might want to enjoy an evening by the fire in your fireplace or woodstove. Make sure that your chimney is structurally in good shape and clean out any debris build up that may cause chimney fires. This usually needs to be done by a professional chimney expert, but is well worth the cost.

-

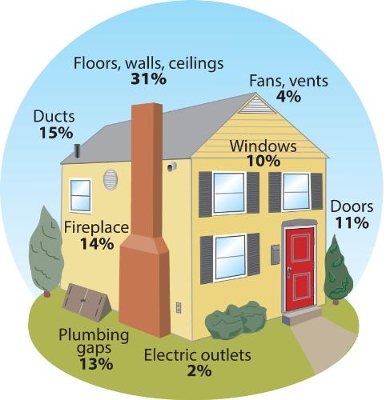

Sealing and weatherstripping in preparation for the winter is always a good idea to keep your heat in your home and should be checked and repaired when you are replacing your screens with storm windows and doors.

-

Get your door drafts ready! In addition to sealing, closing off rooms in your home will help keep each room warmer during the winter months. Door drafts will help prevent cold air from coming in under your doorways – they really do work!

-

Reverse your ceiling fans. In the summer months, your fan blades rotate counterclockwise to push cooler air down to your floor. The cooler air evaporates moisture which helps you feel cooler. In the winter, your ceiling fan should rotate clockwise at low speed. This pulls cool air up which pushes the warmer air near your ceiling down along your walls and back to the floor, making your room feel warmer.

-

Don’t forget to clean out your gutters! Check your gutters for debris after the trees lose most of their leaves to assure for good drainage of melting water during the coming winter months. Check your roof for missing shingles, possible leaks etc.

We hope you have found these tips helpful! Check with Bieritz Agency for all your insurance needs. Call us for a free quote – we can save you money!

Bieritz Insurance Agency, is proud to offer two convenient locations in Otsego County.

Your “Hometown” Insurance Specialists!

HOME • AUTO • BUSINESS • LIFE • FARM • BOAT • CYCLE & MORE

Bieritz Insurance Agency

209 Main Street

Cooperstown, NY 13326

607-547-2951

FAX 607-547-4487

info@bieritzinsurance.com

Morris Insurance Agency

128 Main Street

P.O. Box 70

Morris, NY 13808

607-263-5170

FAX 607-263-5270

agent@morrisinsuranceny.com

If your child is leaving home to attend college, make sure you check with your auto insurance

If your child is leaving home to attend college, make sure you check with your auto insurance

: Complete the form below and click Submit.

: Complete the form below and click Submit. Your homeowners insurance policy covers your property, but if you store your property off your site at a storage facility or self-storage unit, do you need additional protection? In the case of natural disasters like flood, or tornado, the facility is not likely legally responsible for your belongings.

Your homeowners insurance policy covers your property, but if you store your property off your site at a storage facility or self-storage unit, do you need additional protection? In the case of natural disasters like flood, or tornado, the facility is not likely legally responsible for your belongings.

If you find yourself as host to a large gathering this weekend for Superbowl Sunday, this article has some great information about Social Host Liability.

If you find yourself as host to a large gathering this weekend for Superbowl Sunday, this article has some great information about Social Host Liability. From the student’s perspective, a driver’s license represents some very big things: freedom (the ability to go where you want, when you want); independence (not having to depend on parents or others to get there); responsibility (for ones’ self, for passengers, for a car, for gas, for others on the roadways). The driver’s license is one of the milestones in the transition from youth to adult.

From the student’s perspective, a driver’s license represents some very big things: freedom (the ability to go where you want, when you want); independence (not having to depend on parents or others to get there); responsibility (for ones’ self, for passengers, for a car, for gas, for others on the roadways). The driver’s license is one of the milestones in the transition from youth to adult.