Tips for Safe Driving and Insurance Savings

Winter is a beautiful but challenging season for drivers. Cold temperatures, snow, ice, and freezing rain can make road conditions treacherous. To ensure your safety and minimize the risk of accidents during the winter months, it’s crucial to winterize your vehicle. In this article, we’ll discuss vehicle maintenance tips for safe winter driving and explain how regular maintenance can impact your auto insurance rates.

Vehicle Maintenance Tips for Safe Winter Driving

1.  Check Your Tires

Check Your Tires

Your tires are your vehicle’s point of contact with the road, and they play a critical role in ensuring safe winter driving. Here’s what to do:

- Tire Pressure: Cold temperatures can cause tire pressure to drop, so check your tire pressure regularly and inflate them to the recommended levels as indicated in your vehicle’s owner’s manual.

- Tire Tread: Inspect your tire tread depth. Tires with inadequate tread are more likely to lose traction on slippery roads. Consider switching to winter tires for enhanced grip.

- Chains or Snow Tires: If you live in an area with heavy snowfall, consider using snow chains or dedicated snow tires for added traction.

2. Test Your Battery

Cold weather can strain your vehicle’s battery, making it more likely to fail. Before winter sets in, have your battery tested by a mechanic. If it’s nearing the end of its life, consider replacing it to prevent getting stranded in the cold.

3. Inspect Your Brakes

Your brakes are crucial for safe driving year-round, but they become even more critical in winter conditions. Have your brakes inspected by a professional to ensure they’re in good working order.

4. Change Your Oil

Using the right type of oil for winter conditions is essential. Switch to a lower-viscosity oil that flows more easily in cold weather. Regular oil changes are also important for engine health.

5. Check Your Antifreeze

Ensure your vehicle’s cooling system has the right concentration of antifreeze to prevent freezing. A 50/50 mix of antifreeze and water is generally recommended.

6. Maintain Your Lights and Wipers

Visibility is crucial during winter driving. Make sure all your vehicle’s lights are functioning correctly, including headlights, taillights, brake lights, and turn signals. Replace any burnt-out bulbs promptly. Additionally, replace worn wiper blades to ensure clear visibility in rain and snow.

7. Keep Fluid Levels in Check

Check fluid levels regularly, including windshield washer fluid, power steering fluid, and transmission fluid. Make sure they’re at the appropriate levels to prevent problems during winter driving.

8. Carry an Emergency Kit

Prepare an emergency kit for your vehicle that includes essentials like a blanket, flashlight, extra warm clothing, non-perishable food, water, a first-aid kit, and basic tools. You may also want to include items like a shovel, ice scraper, and sand or kitty litter for added traction.

How Regular Maintenance Can Impact Auto Insurance Rates

Auto insurance companies consider various factors when calculating your insurance premiums, and your vehicle’s condition and maintenance can play a role. Here’s how regular maintenance can impact your auto insurance rates:

1. Safety Features and Maintenance Discounts

Many insurance providers offer discounts for vehicles equipped with safety features like anti-lock brakes, airbags, and electronic stability control. Regular vehicle maintenance, including brake checks and tire rotations, can help ensure these safety features are in optimal working condition, potentially making you eligible for discounts.

2. Preventing Accidents

Well-maintained vehicles are less likely to experience mechanical failures that could lead to accidents. For example, regular brake inspections and replacements reduce the risk of brake failure. Fewer accidents mean a lower likelihood of filing claims, which can help you maintain lower insurance premiums.

3. Reducing Claims Frequency

A well-maintained vehicle is less likely to experience breakdowns, which can lead to towing and repair claims. Fewer claims mean you’re less likely to be considered a high-risk driver, which can help keep your premiums lower.

4. Increasing Resale Value

Regular maintenance, such as oil changes and brake pad replacements, can help preserve the value of your vehicle. If you ever need to file a comprehensive or collision claim, a well-maintained vehicle may have a higher claim payout, helping you repair or replace your vehicle more effectively.

5. Compliance with Policy Requirements

Some auto insurance policies may include requirements for maintaining your vehicle in good working condition. Failing to meet these requirements can result in policy cancellations or non-renewals. Regular maintenance ensures you meet these obligations, preventing disruptions in coverage.

Winterizing your vehicle is a crucial step to ensure safe and reliable driving during the cold and challenging winter months. Regular maintenance not only protects your safety on the road but can also impact your auto insurance rates positively. By keeping your vehicle in top condition, you reduce the risk of accidents, claims, and breakdowns, which can help you maintain lower insurance premiums.

Remember that good maintenance practices go hand in hand with safe driving habits. Be cautious when driving in winter weather, reduce your speed, and allow for extra stopping distance. By combining regular maintenance with responsible driving, you can enjoy a safe and cost-effective winter driving experience. Get a free quote on your insurance (NY State) by calling our team at 607-547-2951.

As schools reopen, drivers need to be extra cautious when driving near schools and school buses. Here are some essential safety tips to keep in mind:

As schools reopen, drivers need to be extra cautious when driving near schools and school buses. Here are some essential safety tips to keep in mind: Motorcycles offer a thrilling and liberating way to travel the open road, but they also come with unique risks that demand heightened attention to safety and insurance considerations. In this comprehensive guide, we’ll explore motorcycle safety tips to keep riders safe and delve into the importance of motorcycle insurance, highlighting how it differs from auto insurance.

Motorcycles offer a thrilling and liberating way to travel the open road, but they also come with unique risks that demand heightened attention to safety and insurance considerations. In this comprehensive guide, we’ll explore motorcycle safety tips to keep riders safe and delve into the importance of motorcycle insurance, highlighting how it differs from auto insurance.

Accidents and incidents can happen at any time, but taking precautions and being prepared can help reduce the risk. Whether you’re at home or on the road, there are many steps you can take to stay safe and lower your insurance premiums. In this article, we’ll provide helpful tips for reducing the risk of accidents and incidents in the home and on the road, and show how these tips can help lower insurance premiums.

Accidents and incidents can happen at any time, but taking precautions and being prepared can help reduce the risk. Whether you’re at home or on the road, there are many steps you can take to stay safe and lower your insurance premiums. In this article, we’ll provide helpful tips for reducing the risk of accidents and incidents in the home and on the road, and show how these tips can help lower insurance premiums. Most people know that there are some logical ways to save money on their insurance. Bundling your auto and homeowners insurance with one carrier and agency can qualify you for a discount. You can use higher deductibles or drop some of your coverage levels. You can take driving safety courses or install security systems. These are all things that you can control and adjust as you need to. What you might not realize is that insurance pricing changes on a regular basis and is driven by many different factors. The general recommendation is to re-quote on your policies every 6-12 months.

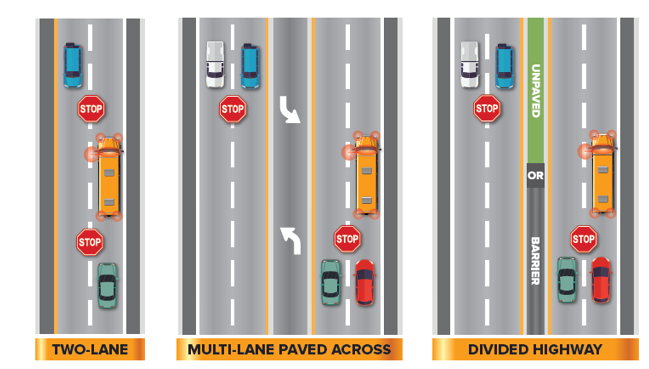

Most people know that there are some logical ways to save money on their insurance. Bundling your auto and homeowners insurance with one carrier and agency can qualify you for a discount. You can use higher deductibles or drop some of your coverage levels. You can take driving safety courses or install security systems. These are all things that you can control and adjust as you need to. What you might not realize is that insurance pricing changes on a regular basis and is driven by many different factors. The general recommendation is to re-quote on your policies every 6-12 months. There is nothing more important than the safety of our children in getting back and forth to school. Whether they are walking, riding a bike or traveling in a school bus, it is imperative for drivers to be constantly aware, patient and exercise caution. Take a look through the following information for a refresher on School Bus Rules of the Road.

There is nothing more important than the safety of our children in getting back and forth to school. Whether they are walking, riding a bike or traveling in a school bus, it is imperative for drivers to be constantly aware, patient and exercise caution. Take a look through the following information for a refresher on School Bus Rules of the Road.

Parking lots contain a lot of potential safety hazards for both pedestrians and drivers. The National Safety Council (NHS) states that

Parking lots contain a lot of potential safety hazards for both pedestrians and drivers. The National Safety Council (NHS) states that

Just like a fine wine, some of our greatest material possessions gain value over time. This is true of exceptional antique automobiles. Your antique automobile must be protected in all ways, from suitable shelter to ample insurance coverage.

Just like a fine wine, some of our greatest material possessions gain value over time. This is true of exceptional antique automobiles. Your antique automobile must be protected in all ways, from suitable shelter to ample insurance coverage. Here is an overview of some of the most frequently asked questions about motorcycle insurance.

Here is an overview of some of the most frequently asked questions about motorcycle insurance.

Everyone wants assurance that he or she is fully protected on the road. Most drivers understand the need for comprehensive, reputable insurance when driving their own vehicles. When you must drive a rental vehicle or operate one that is not your own, having a clear understanding of insurance regulations and coverage in these situations is vital. Don’t be blindsided by finding yourself not as fully covered as you thought. Educate yourself on how insurance works for rentals and other non-owned vehicles, and find out why Bieritz Insurance Agency is a strong choice for all of your insurance needs.

Everyone wants assurance that he or she is fully protected on the road. Most drivers understand the need for comprehensive, reputable insurance when driving their own vehicles. When you must drive a rental vehicle or operate one that is not your own, having a clear understanding of insurance regulations and coverage in these situations is vital. Don’t be blindsided by finding yourself not as fully covered as you thought. Educate yourself on how insurance works for rentals and other non-owned vehicles, and find out why Bieritz Insurance Agency is a strong choice for all of your insurance needs.

Having a new driver in your family can be a nerve-wracking experience. As a parent, your mind somehow jumps to all of the things that can possibly go wrong, and how your newly-permitted driver is yet unequipped to handle different situations in a car. Teaching your teen to drive takes patience and the ability to be objective – you need to provide guidance instead of criticism. We hope the following five tips will help you as you wind your way through these sometimes stressful moments!

Having a new driver in your family can be a nerve-wracking experience. As a parent, your mind somehow jumps to all of the things that can possibly go wrong, and how your newly-permitted driver is yet unequipped to handle different situations in a car. Teaching your teen to drive takes patience and the ability to be objective – you need to provide guidance instead of criticism. We hope the following five tips will help you as you wind your way through these sometimes stressful moments! Most of the summer months are dedicated to storm season. In between the days that are perfect for the beach, with blue and yellow skies, are days full of heavy rain, winds, and flooding, with the occasional–for Upstate New York–hailstorm, tornado, and hurricane. These weather conditions, in combination with increased vacationing travel, road work, and presence of motorcycles and bikes on the roads, contribute to a higher average of fatal accidents taking place in the summer rather than the winter. At times like these, we find ourselves wanting to know how we can maximize driving safety. Below, you will find a list of summertime storm hazards, and ways you can alter your driving to better ensure safety in each of them.

Most of the summer months are dedicated to storm season. In between the days that are perfect for the beach, with blue and yellow skies, are days full of heavy rain, winds, and flooding, with the occasional–for Upstate New York–hailstorm, tornado, and hurricane. These weather conditions, in combination with increased vacationing travel, road work, and presence of motorcycles and bikes on the roads, contribute to a higher average of fatal accidents taking place in the summer rather than the winter. At times like these, we find ourselves wanting to know how we can maximize driving safety. Below, you will find a list of summertime storm hazards, and ways you can alter your driving to better ensure safety in each of them. Stock your car with…

Stock your car with…