The Importance of Reviewing and Updating Insurance Policies in the New Year

As the calendar turns a new page, many individuals and businesses take the opportunity to set resolutions and goals for the year ahead. Among the priorities that often get overlooked is the review and update of insurance policies. However, this crucial step can have a significant impact on financial security, providing peace of mind in the face of life’s uncertainties. In this article, we’ll delve into the importance of reviewing and updating insurance policies at the beginning of the year, and some proactive steps you can take to make sure your coverage is aligned properly with your current circumstances.

As the calendar turns a new page, many individuals and businesses take the opportunity to set resolutions and goals for the year ahead. Among the priorities that often get overlooked is the review and update of insurance policies. However, this crucial step can have a significant impact on financial security, providing peace of mind in the face of life’s uncertainties. In this article, we’ll delve into the importance of reviewing and updating insurance policies at the beginning of the year, and some proactive steps you can take to make sure your coverage is aligned properly with your current circumstances.

Assessing Life Changes:

Life is dynamic, and with it come various changes that can influence insurance needs. Individuals and businesses should assess their life situations as the first step toward ensuring that insurance coverage remains relevant and effective.

- Personal Circumstances: Life events such as marriage, the birth of a child, or changes in health status can significantly impact insurance requirements. A married couple may need to adjust their life insurance policies to adequately protect their growing family. Similarly, the birth of a child may necessitate updates to health insurance plans and considerations for additional coverage.

- Home and Property Changes: Changes in residential circumstances, such as renovations, additions, or the purchase of valuable assets, should prompt a reassessment of homeowners or renters insurance. The value of personal belongings, the structure of the property, and potential liabilities may all be affected by these changes.

- Vehicle Changes: The acquisition of new vehicles or changes in driving habits can impact auto insurance needs. Informing insurance providers about changes in the number of vehicles, mileage, or drivers in the household helps ensure that coverage aligns with the current situation.

- Business Operations: For business owners, changes in operations, expansions, or modifications to the nature of the business may necessitate updates to commercial insurance policies. Staying ahead of these changes ensures that the business is adequately protected against potential risks.

The Importance of Regular Policy Reviews:

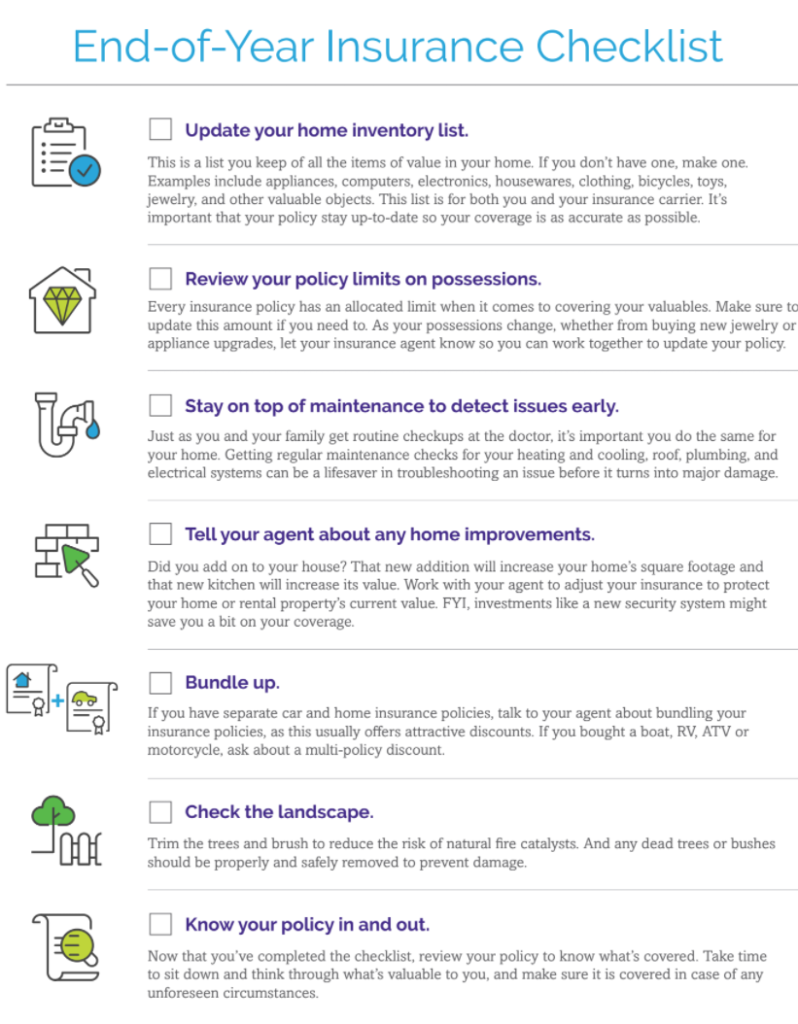

Staying Ahead of Underinsurance: Failing to update insurance policies can lead to underinsurance, where coverage is insufficient to meet actual needs. Regular reviews help individuals and businesses identify gaps in coverage, allowing for the adjustment of policies to better protect against potential risks.

- Taking Advantage of New Coverage Options: The insurance landscape is constantly evolving, with new coverage options emerging to address modern risks. Regular policy reviews present an opportunity to explore and integrate these new options, enhancing overall protection.

- Maximizing Cost-Efficiency: Lifestyle changes and shifts in risk profiles may affect the cost of insurance. A review enables policyholders to explore cost-saving measures, such as bundling policies, adjusting deductibles, or taking advantage of discounts for safety features.

- Adapting to Market Conditions: Economic and market conditions can impact insurance rates and coverage availability. Staying informed about these changes and adapting policies accordingly ensures that coverage remains both comprehensive and cost-effective.

How to Review and Update Policies:

- Compile Policy Documents: Gather all insurance policy documents in one place. This includes homeowners or renters insurance, auto insurance, life insurance, health insurance, and any other relevant policies. Having a comprehensive overview makes the review process more efficient.

- Evaluate Coverage Limits: Assess the coverage limits of each policy. Are they sufficient to cover potential losses in the current circumstances? Adjust coverage limits as needed to align with changes in lifestyle, property values, or business assets.

- Consider Deductibles: Evaluate deductibles for each policy. Adjusting deductibles can impact premium costs, and individuals may choose to increase or decrease deductibles based on their risk tolerance and financial situation.

- Review Beneficiary Information: For life insurance and retirement accounts, review and update beneficiary information. Marriage, divorce, births, and deaths can all influence beneficiary designations, and it’s crucial to ensure that these designations reflect current wishes.

- Explore New Coverage Options: Research and consider any new coverage options that may be relevant. This could include cyber insurance for individuals with increasing digital assets, umbrella policies for added liability protection, or coverage for specific high-value items.

- Update Personal Information: Ensure that personal information provided to insurance providers is accurate and up-to-date. This includes addresses, contact numbers, and any other relevant details. Accurate information helps prevent potential issues during the claims process.

- Consult with an Insurance Professional: Seek guidance from an insurance professional or advisor. Their expertise can provide valuable insights into potential coverage gaps, emerging risks, and cost-saving measures. An insurance professional can also assist in navigating the complexities of policy adjustments.

As we embark on a new year, the importance of reviewing and updating insurance policies cannot be overstated. Life is a journey marked by change, and the landscape of risks and uncertainties evolves alongside it. Taking the time to assess personal and business circumstances, understanding the importance of regular policy reviews, and proactively adapting coverage ensures that insurance remains a reliable shield against the unexpected. By incorporating this practice into annual routines, individuals and businesses can start each year with the confidence that their insurance policies align with their current needs and provide a solid foundation for financial security. Contact our team today at 607-547-2951 for a free quote!

The summer months are ones we look forward to all year long, but they bring certain risks along with the great summer weather. After our long, cold, winter months, we are all more than ready to be outdoors and enjoying fun times with family and friends. To minimize your risks, you can do a quick insurance protection check to make sure you are ready for the summer months.

The summer months are ones we look forward to all year long, but they bring certain risks along with the great summer weather. After our long, cold, winter months, we are all more than ready to be outdoors and enjoying fun times with family and friends. To minimize your risks, you can do a quick insurance protection check to make sure you are ready for the summer months. The transition from one year to the next is often a time of reflection about our lives. We assess the things that we might like to change to make our lives a bit better, feel happier, healthier and more productive. Just as we make assessment of our personal habits, we can assess our surroundings as well. The new year allows us the opportunity to step back and reflect on ways we can make our households run more efficiently – maybe with some re-organization, or updates, repairs and improvements to our home in ways that make sense for our budgets and our future.

The transition from one year to the next is often a time of reflection about our lives. We assess the things that we might like to change to make our lives a bit better, feel happier, healthier and more productive. Just as we make assessment of our personal habits, we can assess our surroundings as well. The new year allows us the opportunity to step back and reflect on ways we can make our households run more efficiently – maybe with some re-organization, or updates, repairs and improvements to our home in ways that make sense for our budgets and our future. One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics.

One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics. One of the best things about summer is the ability to cook outdoors. We hold family barbecues, attend outdoor picnics, and just generally cook outside whenever we can while the season is here. 70% of our households in the U.S. own an outdoor grill or smoker. While a big part of our summer fare, outdoor cooking does not come without risks. An average of 10,600 home fires are caused each year and almost 20,000 emergency room visits are directly related to home grilling and about half of those injuries involve thermal burns. Take a look through these Summer Grilling Safety Tips – recommended by

One of the best things about summer is the ability to cook outdoors. We hold family barbecues, attend outdoor picnics, and just generally cook outside whenever we can while the season is here. 70% of our households in the U.S. own an outdoor grill or smoker. While a big part of our summer fare, outdoor cooking does not come without risks. An average of 10,600 home fires are caused each year and almost 20,000 emergency room visits are directly related to home grilling and about half of those injuries involve thermal burns. Take a look through these Summer Grilling Safety Tips – recommended by  Insurance is meant to protect your home, your car, your belongings and your family from financially devastating incidents. Few people *like* to pay for insurance. For many, home and auto insurance seems like large expenses for something they probably will never need, and for that reason, some will choose to insure for a bare minimum in order to save more and spend less. However, while being underinsured may seem thrifty, in the long run, the money you end up having to pay will likely exceed the amount you save. Here are some of the reasons why being underinsured is more expensive than receiving sufficient insurance.

Insurance is meant to protect your home, your car, your belongings and your family from financially devastating incidents. Few people *like* to pay for insurance. For many, home and auto insurance seems like large expenses for something they probably will never need, and for that reason, some will choose to insure for a bare minimum in order to save more and spend less. However, while being underinsured may seem thrifty, in the long run, the money you end up having to pay will likely exceed the amount you save. Here are some of the reasons why being underinsured is more expensive than receiving sufficient insurance.

Are you contemplating which direction to go in regards to getting insurance? Two general options that people take are applying for insurance locally or applying online. While some insurance buyers like the convenience factor of getting their insurance online, that is usually where the advantages end with online companies. Online insurance companies tend to be mainstream corporations that look to reach far and wide for as many customers as possible, whereas a local insurance company only works to cater to people who live around their area.

Are you contemplating which direction to go in regards to getting insurance? Two general options that people take are applying for insurance locally or applying online. While some insurance buyers like the convenience factor of getting their insurance online, that is usually where the advantages end with online companies. Online insurance companies tend to be mainstream corporations that look to reach far and wide for as many customers as possible, whereas a local insurance company only works to cater to people who live around their area.

It always pays to have insurance — that’s common knowledge. Yet sometimes trying to cut through the terminology and jargon can prove difficult. When shopping for insurance or preparing to file a claim, you may find that you need a little guidance on what some of these terms mean; such is the case with the terms Actual Cash Value, or ACV and Replacement Cost.

It always pays to have insurance — that’s common knowledge. Yet sometimes trying to cut through the terminology and jargon can prove difficult. When shopping for insurance or preparing to file a claim, you may find that you need a little guidance on what some of these terms mean; such is the case with the terms Actual Cash Value, or ACV and Replacement Cost. Many people think of March and April as the time of year for Spring Cleaning. The snow and ice begin to melt away and we start to think about spending more time outdoors. We look at things that we need to to outside in our yards for annual maintenance, and we begin to prepare for tax season – where we look at our financial documents for the year and assess our financial ‘health’. It’s also a great time of year to conduct an annual review of your insurance policies.

Many people think of March and April as the time of year for Spring Cleaning. The snow and ice begin to melt away and we start to think about spending more time outdoors. We look at things that we need to to outside in our yards for annual maintenance, and we begin to prepare for tax season – where we look at our financial documents for the year and assess our financial ‘health’. It’s also a great time of year to conduct an annual review of your insurance policies.