If you want to be energy efficient or stay warm on a budget, you are in luck. Keep reading to learn about ways to stay warm without increasing your energy bill or reinsulating your entire home.

If you want to be energy efficient or stay warm on a budget, you are in luck. Keep reading to learn about ways to stay warm without increasing your energy bill or reinsulating your entire home.

Check Your Glass Doors

Glass doors are often advertised as a positive feature. They provide natural light and a view of the outdoors. Unfortunately, glass is a terrible insulator. If you have touched a window on a cold day, you already know that. In extreme cases, it is noticeable cooler by a door than it is away from it. A frustrating and expensive amount of heat is lost through glass doors. There are several ways you can combat this heat loss. Replacing the door is always an option, either with a more energy-efficient glass door or one that is not made of glass. Newer glass doors usually have an additional insulator in the form of air or plastic that reduces heat loss. There are options that offer all of the benefits glass doors have with none of the associated costs.

There are other options if you do not want to replace your glass door. Simply hanging drapes in front of a glass door can be effective, even if you only close them at night. An estimated 25 percent of home heating costs stem from heat loss caused by windows, glass doors and skylights, so anything you do will make a difference.

Caulk Around Windows

Caulking around windows is a cheap and simple DIY project that can have enormous benefits. A tube of caulk will likely cost less than $10, depending on where you live and the brand you buy. Use the right type for the job to achieve the best results. There are exterior caulks designed specifically for outdoor use and humidity and mold-resistant ones for use in bathrooms.

Even if you have never caulked anything before, it is worth trying. There are numerous how-to YouTube videos available on the subject and even more articles offering advice. Only apply caulk to dry surfaces. You do not want to seal potentially damaging moisture into a crack, which will only cause more problems in the long run.

Use a Programmable Thermostat

Using a programmable thermostat is a great way to save money, as it allows you to be more energy-efficient. Hire someone to install it for you if you do not feel comfortable doing it yourself. It may be the most expensive advice on the list, but it is worth it. According to the EPA, using a programmable thermostat can reduce the cost of heating your home by up to 30 percent, if you use it correctly.

To take full advantage of your thermostat, program it to keep your home at 68 degrees Fahrenheit when you are awake and in the house. If you are sleeping or at work, set it to be 10-12 degrees cooler. This temperature is warm enough to keep your pipes from freezing while still saving you a considerable amount of money.

Buy a Humidifier

While it might sound counterintuitive, humid air holds more heat than dry air. Humidifiers are fairly affordable, and they are well worth the money. The EPA recommends keeping the humidity in your home between 30 and 60 percent for the best indoor air quality. At 40 percent humidity, 68 degrees Fahrenheit in your home will feel equivalent to 74 degrees when the humidity is at 20 percent.

In addition to saving money, using a humidifier will keep your home more comfortable. There are also potential health benefits. Increased humidity in your home may help alleviate allergies, coughs, dry skin and even sinus headaches.

Cook at Home

Cooking or baking at home during the winter is both cost and energy-efficient. Heat given off by your stove is heat your furnace does not have to produce. Since you have to eat, it is a great way to reduce heating costs during the winter months. Cooking at home has several added benefits. It is much cheaper than going out to eat, which will also save you money. It’s usually healthier too, and eating can help you feel warmer.

Complex carbohydrates are among the best foods to help you feel warmer. They increase thermogenesis, which is your body’s heat production. That means you can snack on whole wheat bread, potatoes, quinoa and oatmeal guilt-free this winter.

These are just some of the options available to increase your home’s energy efficiency while helping you stay warm this winter without breaking the bank. We hope you found this advice helpful and that you’re excited to implement these ideas.

If you end up making significant upgrades to your home, contact our offices to see how this might impact your insurance.

This might be a little far fetched but it is wise to consider the risks when you allow someone to hunt on your property

This might be a little far fetched but it is wise to consider the risks when you allow someone to hunt on your property How do you know if you have a high risk pet that will affect either your ability to get insurance or the cost of your current homeowners policy? Insurance companies consider certain dog breeds to be high risk because these breeds tend to be more aggressive and are therefore deemed to be more dangerous:

How do you know if you have a high risk pet that will affect either your ability to get insurance or the cost of your current homeowners policy? Insurance companies consider certain dog breeds to be high risk because these breeds tend to be more aggressive and are therefore deemed to be more dangerous: It’s always an exciting time when your child graduates high school and begins a new career as a college student. Parents often face a mixture of emotions as they watch their children transition from high school to college. On one hand, your student has worked hard to graduate, and is stepping into a new life. One the other, that life is often away from the comforts and familiar faces of their hometown. Bieritz Insurance understands this is both an exciting and sometimes challenging time in the lives of both the students and the parents, and wants to help add an extra sense of security for both.

It’s always an exciting time when your child graduates high school and begins a new career as a college student. Parents often face a mixture of emotions as they watch their children transition from high school to college. On one hand, your student has worked hard to graduate, and is stepping into a new life. One the other, that life is often away from the comforts and familiar faces of their hometown. Bieritz Insurance understands this is both an exciting and sometimes challenging time in the lives of both the students and the parents, and wants to help add an extra sense of security for both.  Summer. It’s the time of year when the days are long and hot. The kids are out of school and nothing seems like a better idea than hanging out around the pool with your family, hosting backyard bbq parties, and enjoying those extra hours of sunshine. It’s not surprising, then, that many homeowners turn their eyes to their own backyards to contemplate the addition of a pool to their property. Homeowners that already have a pool installed will spend time cleaning and prepping the area in anticipation of summer parties and get togethers. Whether you have a pool or are planning to install one, here are some safety tips to help you enjoy it more and worry less.

Summer. It’s the time of year when the days are long and hot. The kids are out of school and nothing seems like a better idea than hanging out around the pool with your family, hosting backyard bbq parties, and enjoying those extra hours of sunshine. It’s not surprising, then, that many homeowners turn their eyes to their own backyards to contemplate the addition of a pool to their property. Homeowners that already have a pool installed will spend time cleaning and prepping the area in anticipation of summer parties and get togethers. Whether you have a pool or are planning to install one, here are some safety tips to help you enjoy it more and worry less. In our little corner of the world, the vacation rental business is booming. While year-round lodging opportunities (hotels, motels, bed and breakfasts, inns, etc.) continue to exist as a mainstay of accommodation options in our area – there are many properties that now cater mostly to the thirteen week summer season – primarily targeted to the baseball camp family audience for weekly rentals. Some of these properties contract with local managers to list and rent their homes as summer vacation rentals and others (more each day) list with one or more of the national rental chains like HomeAway, VRBO (Vacation Rental By Owner) or AirB&B.

In our little corner of the world, the vacation rental business is booming. While year-round lodging opportunities (hotels, motels, bed and breakfasts, inns, etc.) continue to exist as a mainstay of accommodation options in our area – there are many properties that now cater mostly to the thirteen week summer season – primarily targeted to the baseball camp family audience for weekly rentals. Some of these properties contract with local managers to list and rent their homes as summer vacation rentals and others (more each day) list with one or more of the national rental chains like HomeAway, VRBO (Vacation Rental By Owner) or AirB&B.

Every old house homeowner knows there are time of the year when they find some unexpected house guests. When the weather warms in the spring and summer months, the small trails of ants might appear in your kitchen, and in the fall months, as the weather cools, there are sometimes little creepers that find their way into your pantry.

Every old house homeowner knows there are time of the year when they find some unexpected house guests. When the weather warms in the spring and summer months, the small trails of ants might appear in your kitchen, and in the fall months, as the weather cools, there are sometimes little creepers that find their way into your pantry. One of the small joys of the summer season for adults and children alike is being able to go swimming. Cooling off in the water offers relief from the heat and humidity. If you are looking for the convenience and benefits of having your own backyard pool, don’t forget to consider the added cost of insurance into your expenses.

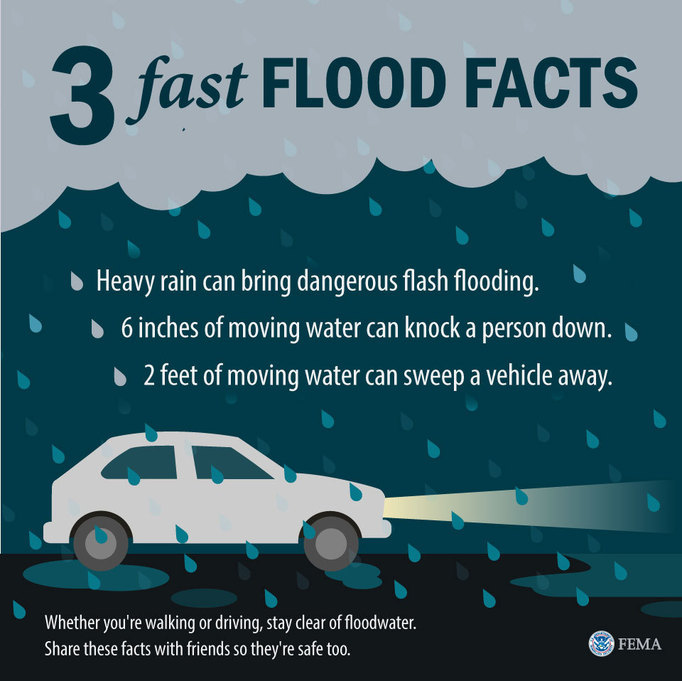

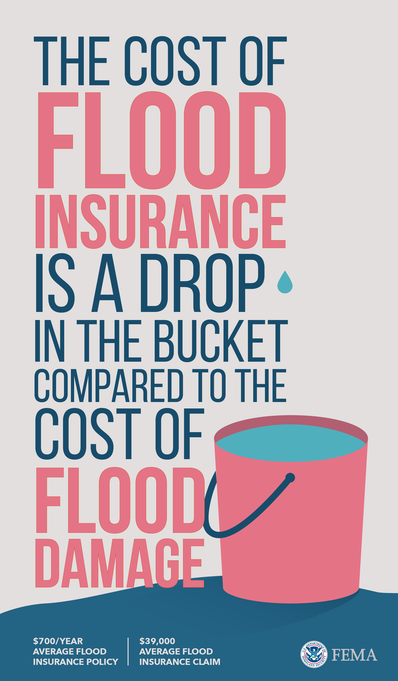

One of the small joys of the summer season for adults and children alike is being able to go swimming. Cooling off in the water offers relief from the heat and humidity. If you are looking for the convenience and benefits of having your own backyard pool, don’t forget to consider the added cost of insurance into your expenses.  Spring is here and with the season’s change comes the rain. It seems that we have had a good deal of precipitation just over the last two weeks in our region – and if you are looking at our local rivers and streams, we are noticing that the water is running fast and high. Floods happen everywhere – they are not relegated to specific regions like tornadoes or hurricanes. Our area has certainly had more than a few years over this last decade where flooding has been severe. For safety, please keep an ear out for warnings and follow the safety suggestions below!

Spring is here and with the season’s change comes the rain. It seems that we have had a good deal of precipitation just over the last two weeks in our region – and if you are looking at our local rivers and streams, we are noticing that the water is running fast and high. Floods happen everywhere – they are not relegated to specific regions like tornadoes or hurricanes. Our area has certainly had more than a few years over this last decade where flooding has been severe. For safety, please keep an ear out for warnings and follow the safety suggestions below!

Knowing when and when not to file an insurance claim is one of the tricks of the trade for someone trying to manage the costs of damage to one’s property or house. Every insurance agency has different regulations for what makes a valid claim, as well as for what policy modifications are necessary after a claim has been made. Often, insurance rates are raised. Based on the circumstances of the claim and of a homeowner’s claim history, policies can even be cancelled and a client can earn a reputation in the field that makes other providers refuse them or offer unaffordable policies. Therefore, it is helpful to know generally when and when NOT to file a claim for property damage.

Knowing when and when not to file an insurance claim is one of the tricks of the trade for someone trying to manage the costs of damage to one’s property or house. Every insurance agency has different regulations for what makes a valid claim, as well as for what policy modifications are necessary after a claim has been made. Often, insurance rates are raised. Based on the circumstances of the claim and of a homeowner’s claim history, policies can even be cancelled and a client can earn a reputation in the field that makes other providers refuse them or offer unaffordable policies. Therefore, it is helpful to know generally when and when NOT to file a claim for property damage.  The Fall Season has officially arrived in our area with the first frost (last night) and the cooler temperatures means that it’s time to start using our fireplaces and wood-burning stoves to help warm a room or to take a bit of the chill out of the air. Before you begin to use these, however, it is recommended to inspect and clean them to make sure they are safe to operate. According to the National Fire Protection Association, this should be done at least once a year, usually in the fall months.

The Fall Season has officially arrived in our area with the first frost (last night) and the cooler temperatures means that it’s time to start using our fireplaces and wood-burning stoves to help warm a room or to take a bit of the chill out of the air. Before you begin to use these, however, it is recommended to inspect and clean them to make sure they are safe to operate. According to the National Fire Protection Association, this should be done at least once a year, usually in the fall months. In addition to annual maintenance, we encourage our families, friends, and clients to always use safe fireplace practices:

In addition to annual maintenance, we encourage our families, friends, and clients to always use safe fireplace practices: Just because you have an older home doesn’t mean you can’t make it into a smart home. Many new home constructions are integrating smart home technologies into design, but even if you have an older home, there are systems you can implement in your home to manage systems that address security, locks, lighting, and heating/cooling. Making your home a “smart home” can help save energy, time and expense and you might be surprised to find that installing some of these smart features can be affordable and can be done yourself!

Just because you have an older home doesn’t mean you can’t make it into a smart home. Many new home constructions are integrating smart home technologies into design, but even if you have an older home, there are systems you can implement in your home to manage systems that address security, locks, lighting, and heating/cooling. Making your home a “smart home” can help save energy, time and expense and you might be surprised to find that installing some of these smart features can be affordable and can be done yourself! August is typically the hottest month of the year here in the Central New York region, and perhaps the only month that we struggle with trying to keep our homes a bit cooler. In many cases it doesn’t make sense to install air conditioning for the short period of time that it might be needed. Considering the small window of time that they are used, air conditioners can significantly increase your electricity costs. If you find yourself on a budget but still needing to make your home more comfortable during the heat of the season, these ideas may be helpful to you!

August is typically the hottest month of the year here in the Central New York region, and perhaps the only month that we struggle with trying to keep our homes a bit cooler. In many cases it doesn’t make sense to install air conditioning for the short period of time that it might be needed. Considering the small window of time that they are used, air conditioners can significantly increase your electricity costs. If you find yourself on a budget but still needing to make your home more comfortable during the heat of the season, these ideas may be helpful to you! Outdoor fire pits have become an increasingly popular outdoor home accessory. If you have a fire pit or are considering adding one to your yard, here are a few things you should think about for safety.

Outdoor fire pits have become an increasingly popular outdoor home accessory. If you have a fire pit or are considering adding one to your yard, here are a few things you should think about for safety.