Spring is a great time of year to look around your home and decide on areas that could use a good refresh. Many homeowners keep a list of projects that they would like to do – now is the time to start crossing a few of those off your list! If you don’t have a list, but want to make some updates before the summer months, here are a few ideas for some outdoor and indoor projects. Some of these will depend on the amount of time and money you have to spend.

Spring is a great time of year to look around your home and decide on areas that could use a good refresh. Many homeowners keep a list of projects that they would like to do – now is the time to start crossing a few of those off your list! If you don’t have a list, but want to make some updates before the summer months, here are a few ideas for some outdoor and indoor projects. Some of these will depend on the amount of time and money you have to spend.

Outdoors:

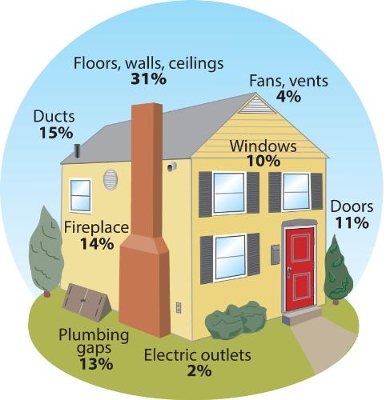

For a good outdoor cleanup, consider renting a power washer on a nice sunny spring day and use it to remove dirt, debris, mold, moss and other materials from your deck or your driveway, the outside of your gutters and maybe even your siding.

If painting is your thing, you could give a fresh coat of paint to your outdoor furniture pieces or maybe repaint your entry door or your house trim.

Landscaping work can include adding a new garden area or sprucing up an existing one. Spring is a great time of year to clear out leaf litter between your house and your shrubs too!

Indoors:

You might add a new rug, buy a new piece of artwork or invest in a good furniture item, or maybe change out your window treatments to let in more sunlight. Try slipcovers for a new look for older furniture pieces.

A change in your lighting can make a big difference as well. If you have an older kitchen, perhaps you might like to update an old appliance or re-invigorate your kitchen cabinets with a new color.

Add a fresh coat of paint to a room or rooms.

Improvements and Your Insurance:

If you decide to do any major improvements on your home, check in with our team at Bieritz Agency to see if there is any added insurance protection you need during or following your renovations. You may want to add big ticket items that you purchase to your contents items on your policy. If you don’t already have a content list, check out our post from last November on Cataloging your Possessions for Insurance.

You can contact our team in Cooperstown at Bieritz Insurance Agency, 209 Main Street , Cooperstown, NY 13326 –

607-547-2951 or in Morris at Morris Insurance Agency, 128 Main Street, Morris, NY 13808 – 607-263-5170. We are happy to help you!

The expenses associated with maintaining your fireplace and chimney each year are minimal in comparison with the costs of a fire. We urge all our clients, family and friends to take the steps necessary to assure safe operations. If you have questions about your insurance coverage in the event of a fire, please contact our team in Cooperstown at 547-2951 or in Morris at 263-5170.

The expenses associated with maintaining your fireplace and chimney each year are minimal in comparison with the costs of a fire. We urge all our clients, family and friends to take the steps necessary to assure safe operations. If you have questions about your insurance coverage in the event of a fire, please contact our team in Cooperstown at 547-2951 or in Morris at 263-5170. We have been very fortunate in our region this year to have not had any significant snowfall so far this winter. But, as we all know – those days are coming! Our favorite snow-shoveling days are the ones where each morning, there is only a tiny layer of new snow – light and powdery enough that all you need is a once over with a broom to sweep it clear. If we are lucky, we will have more than a few of those kinds of snowfalls this winter. Inevitably though, as part of the winter mix, we will end up with some accumulations of wetter snow that will require actual shoveling. Keep in mind some of the following safety tips for when this occurs.

We have been very fortunate in our region this year to have not had any significant snowfall so far this winter. But, as we all know – those days are coming! Our favorite snow-shoveling days are the ones where each morning, there is only a tiny layer of new snow – light and powdery enough that all you need is a once over with a broom to sweep it clear. If we are lucky, we will have more than a few of those kinds of snowfalls this winter. Inevitably though, as part of the winter mix, we will end up with some accumulations of wetter snow that will require actual shoveling. Keep in mind some of the following safety tips for when this occurs.

Your homeowners insurance policy covers your property, but if you store your property off your site at a storage facility or self-storage unit, do you need additional protection? In the case of natural disasters like flood, or tornado, the facility is not likely legally responsible for your belongings.

Your homeowners insurance policy covers your property, but if you store your property off your site at a storage facility or self-storage unit, do you need additional protection? In the case of natural disasters like flood, or tornado, the facility is not likely legally responsible for your belongings.

If you find yourself as host to a large gathering this weekend for Superbowl Sunday, this article has some great information about Social Host Liability.

If you find yourself as host to a large gathering this weekend for Superbowl Sunday, this article has some great information about Social Host Liability. COOPERSTOWN, NY (10/03/14): Bieritz Insurance Agency, a local business providing full spectrum insurance products and services, is reminding area residents to replace their batteries on smoke detection devices in their home.

COOPERSTOWN, NY (10/03/14): Bieritz Insurance Agency, a local business providing full spectrum insurance products and services, is reminding area residents to replace their batteries on smoke detection devices in their home. Bieritz Insurance Agency Inc. is a local Independent insurance agency that represents over 20 companies. Bieritz Agency has served the community as the only locally-owned and operated, independent agency for over 24 years. Bieritz provides quality service, excellent prices and products that are in the client’s best interest! Free quotes are available through both Cooperstown and Morris offices. Contact Bieritz at (607)547-2951.

Bieritz Insurance Agency Inc. is a local Independent insurance agency that represents over 20 companies. Bieritz Agency has served the community as the only locally-owned and operated, independent agency for over 24 years. Bieritz provides quality service, excellent prices and products that are in the client’s best interest! Free quotes are available through both Cooperstown and Morris offices. Contact Bieritz at (607)547-2951. Buying a new home or looking into changes in your homeowners insurance? Watch the video for a great overview of Homeowners Insurance from the Insurance Information Institute. Please call us if you have any questions or if you would like a free quote!

Buying a new home or looking into changes in your homeowners insurance? Watch the video for a great overview of Homeowners Insurance from the Insurance Information Institute. Please call us if you have any questions or if you would like a free quote!