Understanding How It Protects Everyone

Understanding How It Protects Everyone

For many, the image of life insurance is intertwined with providing for a spouse and children after an unexpected loss. While this is undoubtedly a crucial role of life insurance, limiting its benefits to only traditional families overlooks its profound value for individuals in all walks of life. At Bieritz Insurance, we believe in empowering everyone with the knowledge to make informed decisions about their financial future, and that includes understanding how life insurance can be a powerful tool for everyone. Let’s debunk some common myths and explore how life insurance can offer protection and peace of mind, regardless of your family structure.

The Myth of the “Family-Only” Benefit:

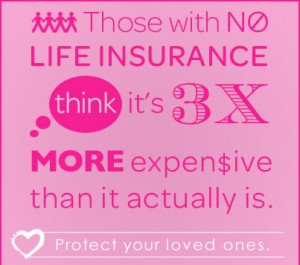

The primary misconception is that life insurance is solely about replacing income for dependent family members. While this is a significant aspect, it’s far from the only one. Life insurance, at its core, is about financial security and planning for the future. That future, and those you care about, may look very different from the traditional family unit.

Life Insurance for Singles: Protecting Your Present and Future

Even without a spouse or children, life insurance can be an invaluable asset for single individuals. Consider these scenarios:

- Debt Protection: Many singles have significant debts, such as student loans, mortgages, or car loans. Without life insurance, these financial obligations could become a burden for your estate or even your loved ones who may be left to handle your affairs. A life insurance policy can help cover these debts, ensuring your passing doesn’t create financial hardship for others.

- Final Expenses: Funeral costs, medical bills, and estate administration fees can be substantial. A life insurance policy, even a smaller one, can provide the funds necessary to cover these final expenses, relieving your family or friends of this financial stress during an already difficult time.

- Leaving a Legacy: You may not have immediate family who depend on your income, but you likely have people and causes you care about. Life insurance allows you to leave a financial legacy to siblings, parents, nieces, nephews, friends, or even charitable organizations close to your heart. It’s a way to make a lasting impact and support what matters most to you.

Couples Without Children: Planning Your Shared Future

For couples who have chosen not to have children, or are not yet parents, life insurance remains a critical component of their financial planning:

- Mutual Support: In a partnership, each individual often contributes significantly to the household’s financial well-being. The loss of one partner can create a significant financial strain on the surviving spouse. Life insurance can provide the necessary funds to maintain their standard of living, cover shared expenses like mortgage payments, and allow them time to adjust without immediate financial pressure.

- Shared Dreams and Goals: Couples often have shared financial goals, such as travel, investments, or early retirement. Life insurance can help ensure that these dreams remain attainable even if one partner is no longer there.

- Estate Planning: Similar to singles, childless couples will still face final expenses and may wish to leave assets to other loved ones or charitable causes. Life insurance can play a vital role in their overall estate plan.

Beyond the Immediate: Long-Term Security for Everyone

Regardless of your current life stage, certain aspects of life insurance offer universal benefits:

- Peace of Mind: Knowing that you have a financial safety net in place can provide significant peace of mind, allowing you to focus on living your life to the fullest.

- Potential for Growth: Some types of life insurance policies offer a cash value component that can grow over time on a tax-deferred basis, providing a potential source of funds for future needs.

- Adaptability: Life insurance policies can often be adjusted as your circumstances change. Whether you get married, have children, or experience other significant life events, your coverage can be reviewed and potentially modified to meet your evolving needs.

Your Local Partner in Protection:

At Bieritz Insurance, we understand that everyone’s life journey is unique. We’re here to listen to your individual circumstances, understand your goals, and help you explore the life insurance options that best fit your needs, regardless of your family structure. Don’t let the myth of “family-only” benefits prevent you from securing your financial future and protecting the people and causes you care about.

Contact us today at 607-547-2951 for a friendly and no-obligation consultation. Let us help you understand how life insurance can be a powerful tool for everyone.

When you’re a young parent, life is a whirlwind of diapers, first steps, and sleepless nights. Amid the chaos and joy of raising a family, one important consideration that often gets overlooked is life insurance. It’s easy to assume that life insurance is something you can put off until later in life, but the reality is that it’s essential, especially for young families. In this article, we’ll explore why life insurance is crucial for young families and provide guidance on choosing the right policy to protect your loved ones today and tomorrow.

When you’re a young parent, life is a whirlwind of diapers, first steps, and sleepless nights. Amid the chaos and joy of raising a family, one important consideration that often gets overlooked is life insurance. It’s easy to assume that life insurance is something you can put off until later in life, but the reality is that it’s essential, especially for young families. In this article, we’ll explore why life insurance is crucial for young families and provide guidance on choosing the right policy to protect your loved ones today and tomorrow. It’s called Life Insurance, but it could just as easily be labeled Love Insurance. Buying life insurance is really an expression of love. It lets loved ones know that you care so much that you’ve made plans to provide for their well-being…even after you’re gone.

It’s called Life Insurance, but it could just as easily be labeled Love Insurance. Buying life insurance is really an expression of love. It lets loved ones know that you care so much that you’ve made plans to provide for their well-being…even after you’re gone.

Explore Part-Time Employment:

Explore Part-Time Employment: One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics.

One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics. Life insurance is a necessity for most adults. Protecting and providing for your family is important should something happen to you. With how drastically our world has changed over the past few months, you may wonder if the life insurance industry has shifted as well.

Life insurance is a necessity for most adults. Protecting and providing for your family is important should something happen to you. With how drastically our world has changed over the past few months, you may wonder if the life insurance industry has shifted as well. When you are looking to protect yourself and your family, you need to consider life insurance. Life insurance is the financial security net that helps your family get through a rough time. But, when shopping for life insurance coverage there are several factors that can impact your premiums. These factors can include your age and gender. A carrier will also take into consideration not only your health history but your family’s. The carrier may also look at what you do for your career and your hobbies. Your choice in your insurance coverage also affects your premium.

When you are looking to protect yourself and your family, you need to consider life insurance. Life insurance is the financial security net that helps your family get through a rough time. But, when shopping for life insurance coverage there are several factors that can impact your premiums. These factors can include your age and gender. A carrier will also take into consideration not only your health history but your family’s. The carrier may also look at what you do for your career and your hobbies. Your choice in your insurance coverage also affects your premium.

Life insurance isn’t a sexy topic, but at some point, it is one that most people have to think about. The question of what happens to your family in the event of your death is an important one to consider. This comes about sometimes after significant life status events – perhaps a marriage, the birth of a child or purchasing a home. Life insurance helps protect your loved ones in the event of your death. It can cover your funeral expenses, pay off your mortgage or provide resources to replace your income for a period of time. Two of the more prevalent types of life insurance are term life and whole life. Knowing a bit about the differences between these two types of insurance can help you to decide which might be the best product for your needs.

Life insurance isn’t a sexy topic, but at some point, it is one that most people have to think about. The question of what happens to your family in the event of your death is an important one to consider. This comes about sometimes after significant life status events – perhaps a marriage, the birth of a child or purchasing a home. Life insurance helps protect your loved ones in the event of your death. It can cover your funeral expenses, pay off your mortgage or provide resources to replace your income for a period of time. Two of the more prevalent types of life insurance are term life and whole life. Knowing a bit about the differences between these two types of insurance can help you to decide which might be the best product for your needs.

Bieritz Insurance Agency is an independent agency working with over 20 companies to offer our customers a variety of options, and find the right product and company to fit your needs. We operate in the beautiful Leatherstocking Region of Central New York and are proud to call the Cooperstown Area our home. We are an Award Winning Allstate Independent Agency, having received recognition for being among the top 30 Independent agents in the United States. Contact us at (607) 547-2951, 209 Main Street, Cooperstown or (607) 263-5170, 128 Main Street, Morris.

Bieritz Insurance Agency is an independent agency working with over 20 companies to offer our customers a variety of options, and find the right product and company to fit your needs. We operate in the beautiful Leatherstocking Region of Central New York and are proud to call the Cooperstown Area our home. We are an Award Winning Allstate Independent Agency, having received recognition for being among the top 30 Independent agents in the United States. Contact us at (607) 547-2951, 209 Main Street, Cooperstown or (607) 263-5170, 128 Main Street, Morris.