In recent years, the concept of “shop local” has gained popularity across the United States, with many communities and businesses promoting the benefits of supporting locally owned and operated businesses. This movement has also taken hold in New York State, with many communities and organizations advocating for the importance of shopping local and supporting the local economy.

One of the primary benefits of shop local initiatives is their impact on the local economy. When consumers shop at locally owned businesses, they are supporting the local economy by keeping money in the community. These businesses are more likely to purchase goods and services from other local businesses, creating a ripple effect that helps to strengthen the local economy. This, in turn, creates jobs and attracts new businesses to the area, making it a more vibrant and prosperous community.

Another benefit of shop local initiatives is the unique and diverse shopping experiences that they provide. Locally owned businesses often offer products and services that are unique to the area, creating a shopping experience that cannot be found at larger chain stores. These businesses are also more likely to offer personalized service and to be active members of the community, creating a sense of connection and community that is difficult to find at larger chain stores.

In addition to the economic and shopping benefits, shop local initiatives also have a positive impact on the environment. Local businesses are often more sustainable and environmentally friendly than larger chain stores. They are more likely to source goods and services locally, reducing the carbon footprint associated with transportation, and to implement environmentally friendly practices in their operations.

Shop local initiatives also help to foster a sense of community and build stronger relationships between local businesses and consumers. Local businesses are more likely to be involved in community events and to support local organizations and causes, helping to create a sense of community and to build relationships with the customers they serve.

In New York State, many communities and organizations have embraced the shop local movement and are working to promote its benefits. These initiatives range from local “buy local” campaigns to events that celebrate and support local businesses. There are also a number of organizations, such as the New York State Independent Business Alliance, that work to promote the benefits of shopping local and to support the growth of locally owned businesses in the state.

The benefits of shop local initiatives in New York State are numerous and far-reaching. These initiatives promote the local economy, provide unique and diverse shopping experiences, have a positive impact on the environment, foster a sense of community, and build stronger relationships between local businesses and consumers. By shopping local, New York State residents can help to support the growth and development of their communities and to build a more vibrant and prosperous state.

Accidents and incidents can happen at any time, but taking precautions and being prepared can help reduce the risk. Whether you’re at home or on the road, there are many steps you can take to stay safe and lower your insurance premiums. In this article, we’ll provide helpful tips for reducing the risk of accidents and incidents in the home and on the road, and show how these tips can help lower insurance premiums.

Accidents and incidents can happen at any time, but taking precautions and being prepared can help reduce the risk. Whether you’re at home or on the road, there are many steps you can take to stay safe and lower your insurance premiums. In this article, we’ll provide helpful tips for reducing the risk of accidents and incidents in the home and on the road, and show how these tips can help lower insurance premiums. Finding the right person to work with you on your home improvements can be a challenge. In our region, it is an industry where very few have websites to provide helpful information about who they are, how long they have been in business or examples of their work. Instead, much of our connection with potential businesses comes through social media posts and referrals.

Finding the right person to work with you on your home improvements can be a challenge. In our region, it is an industry where very few have websites to provide helpful information about who they are, how long they have been in business or examples of their work. Instead, much of our connection with potential businesses comes through social media posts and referrals. When embarking on home improvement projects, one of the first decisions is whether to do it yourself or to hire a professional. If you feel you have the skillset to undertake a particular project, then it might make sense to proceed with it. If you are not sure, remember that time is valuable – and if you make a mistake, you may likely have to do all the work over again or possibly end up calling a professional anyway. Make sure you consider your ‘worst case scenario’ and let that help guide you in your decision.

When embarking on home improvement projects, one of the first decisions is whether to do it yourself or to hire a professional. If you feel you have the skillset to undertake a particular project, then it might make sense to proceed with it. If you are not sure, remember that time is valuable – and if you make a mistake, you may likely have to do all the work over again or possibly end up calling a professional anyway. Make sure you consider your ‘worst case scenario’ and let that help guide you in your decision. The summer months are ones we look forward to all year long, but they bring certain risks along with the great summer weather. After our long, cold, winter months, we are all more than ready to be outdoors and enjoying fun times with family and friends. To minimize your risks, you can do a quick insurance protection check to make sure you are ready for the summer months.

The summer months are ones we look forward to all year long, but they bring certain risks along with the great summer weather. After our long, cold, winter months, we are all more than ready to be outdoors and enjoying fun times with family and friends. To minimize your risks, you can do a quick insurance protection check to make sure you are ready for the summer months. Outdoor recreation activities over the past few years (since the onset of COVID-19) has boomed with people throughout the U.S. looking for safe spaces with fresh air and good opportunities for socially distanced recreation. Here in New York, there are parts of the Catskills that were inundated with so many people, trails were closed in order to protect them from foot traffic. This surge in interest in outdoor activities has also spurred increased visitation at National Parks throughout the country. Those numbers continued to increase in 2021 – with close to 300 million visits and record high numbers in forty-four parks.

Outdoor recreation activities over the past few years (since the onset of COVID-19) has boomed with people throughout the U.S. looking for safe spaces with fresh air and good opportunities for socially distanced recreation. Here in New York, there are parts of the Catskills that were inundated with so many people, trails were closed in order to protect them from foot traffic. This surge in interest in outdoor activities has also spurred increased visitation at National Parks throughout the country. Those numbers continued to increase in 2021 – with close to 300 million visits and record high numbers in forty-four parks. Living in a classic old house is a privilege. Older homes can evoke a sense of beauty, love, charisma. They have a level of character and craftsmanship that are no longer seen in todays modern houses. However, during the cold winters, an older home can be quite uncomfortable. If you are looking into insulation, you may find the information here to be helpful.

Living in a classic old house is a privilege. Older homes can evoke a sense of beauty, love, charisma. They have a level of character and craftsmanship that are no longer seen in todays modern houses. However, during the cold winters, an older home can be quite uncomfortable. If you are looking into insulation, you may find the information here to be helpful.  Most people know that there are some logical ways to save money on their insurance. Bundling your auto and homeowners insurance with one carrier and agency can qualify you for a discount. You can use higher deductibles or drop some of your coverage levels. You can take driving safety courses or install security systems. These are all things that you can control and adjust as you need to. What you might not realize is that insurance pricing changes on a regular basis and is driven by many different factors. The general recommendation is to re-quote on your policies every 6-12 months.

Most people know that there are some logical ways to save money on their insurance. Bundling your auto and homeowners insurance with one carrier and agency can qualify you for a discount. You can use higher deductibles or drop some of your coverage levels. You can take driving safety courses or install security systems. These are all things that you can control and adjust as you need to. What you might not realize is that insurance pricing changes on a regular basis and is driven by many different factors. The general recommendation is to re-quote on your policies every 6-12 months. New York State is making a huge push to help homeowners and businesses transition out of fossil fuel dependence. Through

New York State is making a huge push to help homeowners and businesses transition out of fossil fuel dependence. Through  It’s the time of year when our snow-loving neighbors venture forth on wintery trails throughout our region. According to the International Snowmobile Manufacturers Association, in 2021, there were over 1.3 billion snowmobiles registered in the U.S. – over 100,000 of these are in New York State. New York offers thousands of miles of snowmobile trails that wind their way through some of the most beautiful and scenic parts of the state including the Catskill Mountains and the Adirondacks.

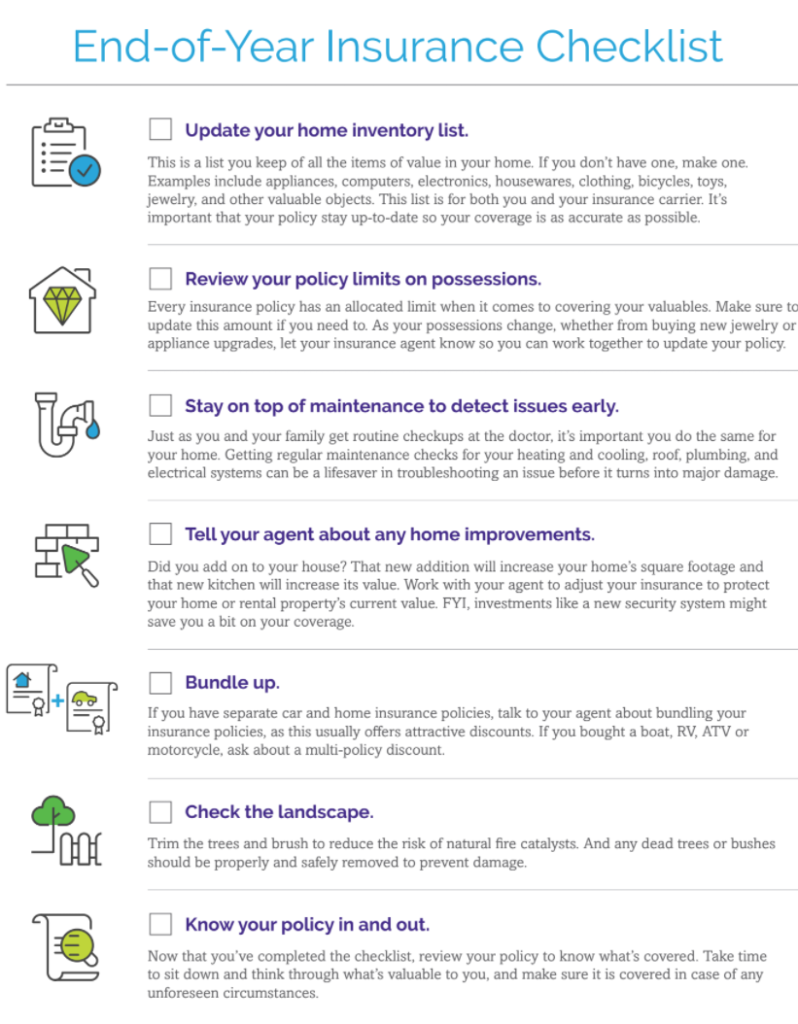

It’s the time of year when our snow-loving neighbors venture forth on wintery trails throughout our region. According to the International Snowmobile Manufacturers Association, in 2021, there were over 1.3 billion snowmobiles registered in the U.S. – over 100,000 of these are in New York State. New York offers thousands of miles of snowmobile trails that wind their way through some of the most beautiful and scenic parts of the state including the Catskill Mountains and the Adirondacks. The transition from one year to the next is often a time of reflection about our lives. We assess the things that we might like to change to make our lives a bit better, feel happier, healthier and more productive. Just as we make assessment of our personal habits, we can assess our surroundings as well. The new year allows us the opportunity to step back and reflect on ways we can make our households run more efficiently – maybe with some re-organization, or updates, repairs and improvements to our home in ways that make sense for our budgets and our future.

The transition from one year to the next is often a time of reflection about our lives. We assess the things that we might like to change to make our lives a bit better, feel happier, healthier and more productive. Just as we make assessment of our personal habits, we can assess our surroundings as well. The new year allows us the opportunity to step back and reflect on ways we can make our households run more efficiently – maybe with some re-organization, or updates, repairs and improvements to our home in ways that make sense for our budgets and our future.

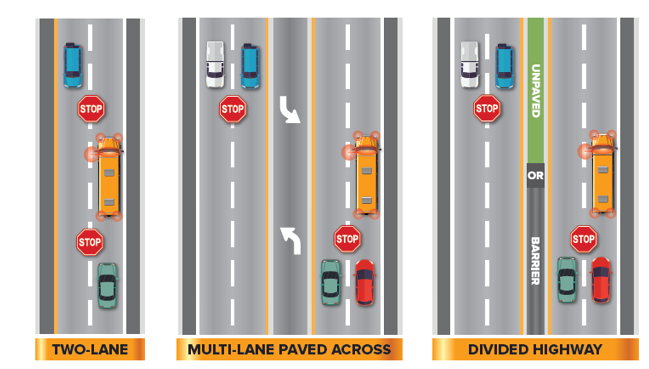

There is nothing more important than the safety of our children in getting back and forth to school. Whether they are walking, riding a bike or traveling in a school bus, it is imperative for drivers to be constantly aware, patient and exercise caution. Take a look through the following information for a refresher on School Bus Rules of the Road.

There is nothing more important than the safety of our children in getting back and forth to school. Whether they are walking, riding a bike or traveling in a school bus, it is imperative for drivers to be constantly aware, patient and exercise caution. Take a look through the following information for a refresher on School Bus Rules of the Road.

One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics.

One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics. One of the best things about summer is the ability to cook outdoors. We hold family barbecues, attend outdoor picnics, and just generally cook outside whenever we can while the season is here. 70% of our households in the U.S. own an outdoor grill or smoker. While a big part of our summer fare, outdoor cooking does not come without risks. An average of 10,600 home fires are caused each year and almost 20,000 emergency room visits are directly related to home grilling and about half of those injuries involve thermal burns. Take a look through these Summer Grilling Safety Tips – recommended by

One of the best things about summer is the ability to cook outdoors. We hold family barbecues, attend outdoor picnics, and just generally cook outside whenever we can while the season is here. 70% of our households in the U.S. own an outdoor grill or smoker. While a big part of our summer fare, outdoor cooking does not come without risks. An average of 10,600 home fires are caused each year and almost 20,000 emergency room visits are directly related to home grilling and about half of those injuries involve thermal burns. Take a look through these Summer Grilling Safety Tips – recommended by