Video: Six Secrets to Know When Renting a Car – by Lauren Fix

Articles

Travel and Rental Car Insurance

Do you need to purchase extra Rental Car Insurance on your trip?

Summer vacation travel season is here! If you are planning on heading out of town and using a rental car for your trip, you might find some of the information here helpful.

Summer vacation travel season is here! If you are planning on heading out of town and using a rental car for your trip, you might find some of the information here helpful.

Typically, when you are renting a car while on a personal vacation, your regular auto insurance policy will cover you for most of your needs. If you are traveling for business, your personal auto policy will not cover damage if you are renting for a business trip. If you have insurance for auto, renter or homeowner, you are likely already covered for liability, personal accident and personal effects coverage. The only coverage you might consider adding is additional collision damage insurance for a rental car. You can purchase this coverage to also include loss of use charges should a vehicle need to be repaired after an incident. This coverage can often be purchased through your private insurance provider for a minimal daily charge – far less than the upsell through a car rental agency.

If you are not covered by a private policy, you may be able to add rental car coverage through your major credit card account. Check with Visa, Mastercard, Discover and American Express through the phone numbers on the back of your cards. To receive the coverage through a credit card company, you must charge the entire rental on the credit card and decline the supplemental collision damage coverage offered by the rental company. It is important to note that you can’t have both. Coverage through the credit card company may have additional restrictions based on the length of the rental term, the type of vehicle you are renting, or what country you are renting from.

Another option is to purchase special travel insurance for your trip, to help cover your trip investment. Travel insurance helps to cover your trip investment if you have flight cancellations due to illness, injuries, weather incidents or other travel related issues. It can help you replace lost baggage, theft of property, tour operator bankruptcy, and more. Travel insurance also has the option for adding collision coverage for a rental vehicle as part of your vacation insurance package.

What rental car insurance can do is protect you from a surcharge on your policy premium for a claim on an accident when driving a rental car. It also can protect you from ‘loss of use’ charges when the rental car has to be off the road for repairs. If you are declining additional coverage, always make sure you take the time to read the fine print on your rental contract before signing for your vehicle, and make sure that it indicates that you are declining the additional insurance.

If you have any questions, check with our team at Bieritz Agency before your trip so we can help to advise you on what makes the most sense for you. We offer two convenient locations in Cooperstown and Morris.

Video: Spring Home Maintenance Tips

A quick look at some tips for your Spring Home Maintenance – to complement our post from earlier this month on Spring Project Ideas for your Property

Spring Project Ideas for your Property

Spring is a great time of year to look around your home and decide on areas that could use a good refresh. Many homeowners keep a list of projects that they would like to do – now is the time to start crossing a few of those off your list! If you don’t have a list, but want to make some updates before the summer months, here are a few ideas for some outdoor and indoor projects. Some of these will depend on the amount of time and money you have to spend.

Spring is a great time of year to look around your home and decide on areas that could use a good refresh. Many homeowners keep a list of projects that they would like to do – now is the time to start crossing a few of those off your list! If you don’t have a list, but want to make some updates before the summer months, here are a few ideas for some outdoor and indoor projects. Some of these will depend on the amount of time and money you have to spend.

Outdoors:

For a good outdoor cleanup, consider renting a power washer on a nice sunny spring day and use it to remove dirt, debris, mold, moss and other materials from your deck or your driveway, the outside of your gutters and maybe even your siding.

If painting is your thing, you could give a fresh coat of paint to your outdoor furniture pieces or maybe repaint your entry door or your house trim.

Landscaping work can include adding a new garden area or sprucing up an existing one. Spring is a great time of year to clear out leaf litter between your house and your shrubs too!

Indoors:

You might add a new rug, buy a new piece of artwork or invest in a good furniture item, or maybe change out your window treatments to let in more sunlight. Try slipcovers for a new look for older furniture pieces.

A change in your lighting can make a big difference as well. If you have an older kitchen, perhaps you might like to update an old appliance or re-invigorate your kitchen cabinets with a new color.

Add a fresh coat of paint to a room or rooms.

Improvements and Your Insurance:

If you decide to do any major improvements on your home, check in with our team at Bieritz Agency to see if there is any added insurance protection you need during or following your renovations. You may want to add big ticket items that you purchase to your contents items on your policy. If you don’t already have a content list, check out our post from last November on Cataloging your Possessions for Insurance.

You can contact our team in Cooperstown at Bieritz Insurance Agency, 209 Main Street , Cooperstown, NY 13326 –

607-547-2951 or in Morris at Morris Insurance Agency, 128 Main Street, Morris, NY 13808 – 607-263-5170. We are happy to help you!

Inspecting your Trees for Damage

To complement our earlier post this month on Trees and your Insurance, here is a helpful video on inspecting your trees!

Trees and Your Insurance

Spring is a good time to check your property for tree damage.

Spring weather can be erratic, as we well know this year from our April sub-freezing temperatures and snow storms. Despite this, we can say with certainty, it will begin to warm up. As your yard becomes walk-able once again, we encourage you to take a trip around your property to look for any damage to your trees.

If you have a tree that falls on your property and it hits your home or your auto, you are protected for repairs under your homeowner’s insurance policy. If you have a tree that falls on a neighbor’s property, their homeowner’s policy should cover any damages. Some of these claims can get complicated, so we would encourage you to check with your office if you have any questions in this circumstance.

Typically, if you have a homeowner’s policy with a high deductible, the expense for a claim may cost more than the cost of the removal of a potentially hazardous tree. We encourage all of our homeowner clients to take steps towards prevention of damages each year, during the spring months. Inspect your property and look for any potential hazards (trees that are diseased, branches that are unstable, etc.). Do some trimming or tree removal when/if needed. Check with a local company to find out when their busy season is so that you can schedule for removal in the off-season when costs might be a bit lower.

A once a year property inspection can end up saving you headaches down the road and can save you money! If you have any questions about your homeowner’s policy or other insurance products, please call our offices in Cooperstown at 607-547-2951 or in Morris at 607-263-5170. We are happy to help you.

Health Insurance Documentation and Your 2015 Tax Return

A comprehensive overview of the Health Insurance documentation needed for your 2015 Tax Return.

Home and Household Tax Deductions

With just a little more than a month left for filing tax returns this year, it’s a good time to think about what things might qualify for an extra deduction. In addition to your mortgage and some loan interest payments, some of your 2015 household improvements might be deductible.

With just a little more than a month left for filing tax returns this year, it’s a good time to think about what things might qualify for an extra deduction. In addition to your mortgage and some loan interest payments, some of your 2015 household improvements might be deductible.

Home improvements eligible for deduction or tax credit include:

- Installation of new storm doors or energy-efficient windows, insulation, air-conditioning or heating systems can qualify for an energy efficiency tax credit of 10% or up to $500 ($200 maximum towards windows).

- Renovations and improvements to your home due to a medical condition may be tax deductible.

- Solar and wind power systems can qualify for as much as 30% of the equipment cost and installation under the renewable-energy tax credit. This credit will continue into next year for systems that are installed before the end of December 2016.

Home office tax deductions:

- Home office deductions for those who work from home can include deductions for expenses relating to a qualified office for things like phone lines, heating, electricity, and renovations as well as a portion of your mortgage interest, property taxes and insurance.

Household education deductions (for children attending college or for your continuing education expenses):

- The American Opportunity tax credit is worth up to $2500 per year for qualifying expenses related to the first four years of higher education. Student must be enrolled in a degree or credential program. The Lifetime Learning Credit, $2000 per year, is not restricted to the first four years of school. There is also a Tuition and Fees Deduction – for up to $4,000.

If any of these items apply to you in 2015, be sure to check with your accountant to see if you are eligible for any of these deductions. Don’t forget to provide documentation. Also, make sure that any improvements to your home are documented for your homeowners insurance. If you have questions about this, please contact our team at Bieritz Insurance in Cooperstown at 607-547-2951 or in Morris at 607-263-5170. We are happy to assist you!

Washing your car in the winter

What’s the point of washing your car in the winter? If you own and use an automobile in our area, this video will talk about why it’s important!

Fireplace Safety

Despite the fact that this winter has been mild so far in comparison to the last two years, the months of February and March are still key months for fireplace use. By keeping in mind the following fireplace safety tips, you can protect your property and the lives of your family and neighbors.

- Inspect and clean your chimney and fireplace once a year (typically in the fall) to remove soot and creosote build up and to make sure they are able to operate safely. A chimney professional will use specialized vacuums to clean the firebox, smoke chamber, damper, smoke shelf and flue liner and will report on any system deficiencies found. They can also check the chimney and cap for deterioration or signs of damage.

- Install smoke and carbon monoxide detectors on each level of your home, and keep them in working order.

- Test your fireplace with a few small pieces of seasoned wood to make sure that smoke does not enter the room.

- When operating your fireplace, make sure you remove any combustible materials from the area around your hearth, and use a mesh screen to keep embers in the fireplace. Glass fireplace doors should be kept open when a fire is burning so that the fire receives air to complete combustion and reduce creosote build up in the chimney.

- Use the correct wood – dense wood types (oak, ash, maple) that have been stored in a dry area for 6 months or more are best – split wood dries more thoroughly and burns better than whole logs. Firewood should be stored a minimum of 30 feet away from your home.

- Never use flammable liquids to start fires – use matches or a commercial firelighter, and never burn cardboard, trash or debris.

- Do not close dampers until the fire is completely out.

- Clean out excess ash so that it doesn’t impede airflow for your fire. An inch of ash at the bottom actually helps to maintain a fire. Ashes can take several days to cool completely. Keep them in a metal container located at least 10 feet away from any buildings.

The expenses associated with maintaining your fireplace and chimney each year are minimal in comparison with the costs of a fire. We urge all our clients, family and friends to take the steps necessary to assure safe operations. If you have questions about your insurance coverage in the event of a fire, please contact our team in Cooperstown at 547-2951 or in Morris at 263-5170.

The expenses associated with maintaining your fireplace and chimney each year are minimal in comparison with the costs of a fire. We urge all our clients, family and friends to take the steps necessary to assure safe operations. If you have questions about your insurance coverage in the event of a fire, please contact our team in Cooperstown at 547-2951 or in Morris at 263-5170.

Safe Riders Video

The video below is put together by the International Snowmobile Manufacturers Association and contains comprehensive information about safe snowmobiling. Twenty minutes well-spent if you are new to this sport! We wish all our snowmobiling friends and clients a safe season. Please let us know if you have any questions about your insurance needs for your vehicle!

Snowmobiling in Otsego County

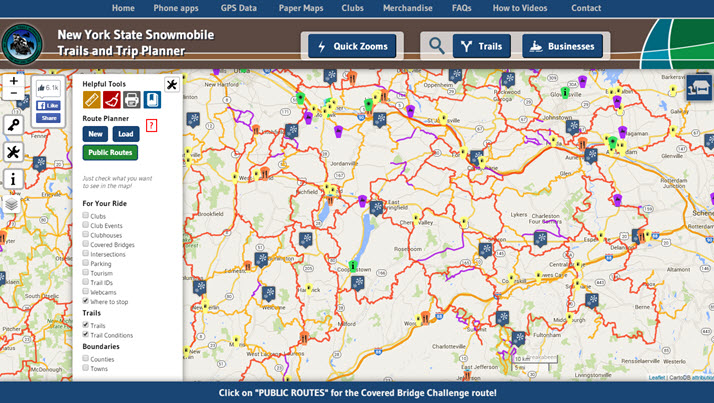

If you are a snowmobiling enthusiast, you know that our area is a great place to play! According to iloveny.com, New York offers over 10,400 miles of trails throughout the state. There are over 230 local clubs associated with the New York State Snowmobiling Association and information available on events, trails, places to stay, tips and more. This coming weekend is a free snowmobiling weekend to encourage out-of-state and Canadian enthusiasts to sled in NY (the registration fee is waived for the weekend for properly registered and insured out-of state snowmobilers).

Locally, there are some great snowmobiling resources available for riders. One of our favorite resources is a locally developed phone app that can be accessed even when cellular data service is not available – a great feature for when you are not sure what direction to go when riding our local trails. The premium app for all of New York State is available for download at both the AppStore and Google Play for $20. Find parking, areas of interest, tourism locations, stopping areas and trails and trail conditions along with additional tools to help plan your route. This technology is developed by Mohawk Valley GIS , a Utica based company established in 2003 by Linda Rockwood.

You can access the information online as well at http://www.nysnowmobilewebmap.com/webmap/.

Don’t forget, if you need help with insurance for your Snowmobile, we are happy to assist you! Contact our team at our Cooperstown office at 607-547-2951 or at our Morris Office at 607-263-5170.

Video – Holiday Season Fire Safety

There’s no place like home for the holidays and no better place to implement good fire safety practices. Follow these simple steps to help ensure your holiday is memorable for all the right reasons. From the Electrical Safety Foundation International (ESFI):

Snow Removal Safety

We have been very fortunate in our region this year to have not had any significant snowfall so far this winter. But, as we all know – those days are coming! Our favorite snow-shoveling days are the ones where each morning, there is only a tiny layer of new snow – light and powdery enough that all you need is a once over with a broom to sweep it clear. If we are lucky, we will have more than a few of those kinds of snowfalls this winter. Inevitably though, as part of the winter mix, we will end up with some accumulations of wetter snow that will require actual shoveling. Keep in mind some of the following safety tips for when this occurs.

We have been very fortunate in our region this year to have not had any significant snowfall so far this winter. But, as we all know – those days are coming! Our favorite snow-shoveling days are the ones where each morning, there is only a tiny layer of new snow – light and powdery enough that all you need is a once over with a broom to sweep it clear. If we are lucky, we will have more than a few of those kinds of snowfalls this winter. Inevitably though, as part of the winter mix, we will end up with some accumulations of wetter snow that will require actual shoveling. Keep in mind some of the following safety tips for when this occurs.

First, make sure you are able to safely shovel – if you have back problems or a heart condition, you might want to check with your doctor first, or consider finding someone to hire for the task. Some landscaping companies will contract with you for snow clearing services through the winter months or if you know any local youths, they might be interested in an extra few dollars in their pockets.

If you are able to shovel, before you go out make sure you are dressed properly – with layers of clothing, warm socks, hat, gloves and shoes that offer traction on slippery surfaces. Take a few moments to limber up as well to warm your muscles for the task. Remember to take breaks frequently and stay well-hydrated. If you experience any pain while shoveling, you should stop immediately.

Choosing the right tool for the job is likely one of the most important things you can do to prevent injury and strain. A plastic small-bladed shovel with a curved handle is best. The curved handle helps you to keep your back straighter while shoveling and the small blade assures that you won’t be lifting too much snow at a time. It is better to push snow rather than lift it when possible which is why it is recommended to shovel more frequently to clear new snow than to wait until the storm ends and clear it all at once. One large shovelful of snow can weigh 25 pounds!

You can increase your leverage while shoveling by keeping your hands at least a foot apart on the shovel. If you need to lift snow, remember to remove it in smaller shovelfuls and use your legs to lift and move – try to avoid twisting.

Our team at Bieritz Insurance wishes you a wonderful and safe winter season, free from injuries and with only the amount of snow you can handle!

Santa’s Schedule at Pioneer Park 2015

We take this opportunity to welcome Santa and Mrs. Claus back to their cottage on Pioneer Park this year. Come enjoy the spirit of Christmas in Cooperstown!

We take this opportunity to welcome Santa and Mrs. Claus back to their cottage on Pioneer Park this year. Come enjoy the spirit of Christmas in Cooperstown!

Each year Pioneer Park in Cooperstown is transformed into an enchanting “Christmas village” for the holidays. Santa arrived in his horse drawn sleigh at his cottage in Pioneer Park on November 27th.

For your convenience – Santa’s schedule for December is posted below:

December

4th 3 – 6 pm

5th 10 – 11 am Mrs. Claus Story Time

5th 1 – 5 pm

6th 1 – 4 pm

11th 3 – 6 pm

12th 10 – 11 am, Mrs. Claus Story Time

12th 1 – 5 pm

13th 1 –4 pm

17th 3 – 6 pm

18th 3 – 6 pm

19th 1 – 5 pm

20th 1 – 4 pm

21st 1 – 4 pm

22nd 1 – 4 pm

23rd 1 – 4 pm

24th 1 – 4 pm

VIDEO: Know Your Stuff

To go along with this month’s focus on home inventories, this video gives a nice overview of the Know Your Stuff app/program.

Cataloging your possessions for insurance

A homeowner’s insurance policy covers replacement value of your home and possessions in the event of a catastrophe, break-ins or other events. If you need to make a claim, you will need documentation of your household possessions to prove replacement value. Our favorite tool to help you with the process of cataloging your possessions among several available is one called ‘Know Your Stuff’.

Important Note: Before you begin this process, it is recommended that you check with your insurance provider to see if they have specific reimbursement requirements so that you can be aware of them for your inventory.

Know Your Stuff is a free online inventory service provided by the Insurance Information Institute. The site will walk you through configuring rooms in your home and listing the specific items in each area, complete with photos and receipts for documentation. Because the site walks you through everything you need to enter, you can be sure you’re recording all of the right information. When you are finished with your documentation, everything is stored securely online, so you have easy access to your home inventory from anywhere you have an Internet connection.

Even though an online service makes things easier than keeping an inventory on paper, it can still be frustrating to have to photograph all of your possessions and attach those photos one by one to your inventory. To simplify things, Know Your Stuff also has a free app for both iPhone and Android phones. Using the app, you can modify or add to your online inventory—and easily add photos directly from your phone.

We think that Know Your Stuff has the most comprehensive toolset available on the web or your mobile device, which makes it our top recommendation for the best digital home inventory tool.

If you are not quite happy with Know Your Stuff, there are other tools available (also for free) including:

-

Allstate Digital Locker works on the web, iPhone, or Android.

-

State Farm HomeIndex works on the web, but can easily be accessed by a mobile device, too.

-

Liberty Mutual Home Gallery lets you take a photo inventory using your iPhone, iPad, or Android device.

If you are looking for any additional information about cataloging your household, please feel free to contact us. Bieritz Agency can help you with all your insurance needs. Call us for a free quote – we can save you money!

Bieritz Insurance Agency, is proud to offer two convenient locations in Otsego County.

Your “Hometown” Insurance Specialists!

HOME • AUTO • BUSINESS • LIFE • FARM • BOAT • CYCLE & MORE

Bieritz Insurance Agency

209 Main Street

Cooperstown, NY 13326

607-547-2951

FAX 607-547-4487

info@bieritzinsurance.com

Morris Insurance Agency

128 Main Street

P.O. Box 70

Morris, NY 13808

607-263-5170

FAX 607-263-5270

agent@morrisinsuranceny.com

Ceiling Fans are for Winter Too

If you have had trouble with understanding why you should use your ceiling fans in the winter, this short video should help!

Getting your home ready for the winter

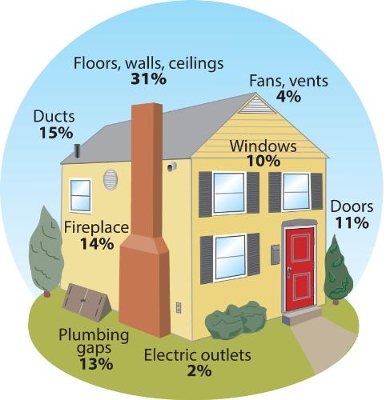

The fall months present a great opportunity for home projects that can help you prevent incidents over the winter season. In addition to accident and damage prevention, some of these can save you some money on energy costs as well! Here are a few tips to help you get your home ready for the winter.

-

Common Home Air Leak Areas Survey your property for dead tree limbs and remove them before they fall during a storm. Taking down dead and dying tree limbs can prevent damage to your home and power lines. Make sure you take safety precautions or hire a local professional to help you with this.

-

Check your plumbing. Are there water pipes in your home that are susceptible to freezing over the winter months? You can insulate your pipes with pre-slit pipe foam (available at most hardware and home repair stores). Just cut pieces to the proper length for exposed pipes and use duct tape to secure them. You can also insulate your water heater too!

-

Inspect and clean your chimney. As we move into the fall months, you might want to enjoy an evening by the fire in your fireplace or woodstove. Make sure that your chimney is structurally in good shape and clean out any debris build up that may cause chimney fires. This usually needs to be done by a professional chimney expert, but is well worth the cost.

-

Sealing and weatherstripping in preparation for the winter is always a good idea to keep your heat in your home and should be checked and repaired when you are replacing your screens with storm windows and doors.

-

Get your door drafts ready! In addition to sealing, closing off rooms in your home will help keep each room warmer during the winter months. Door drafts will help prevent cold air from coming in under your doorways – they really do work!

-

Reverse your ceiling fans. In the summer months, your fan blades rotate counterclockwise to push cooler air down to your floor. The cooler air evaporates moisture which helps you feel cooler. In the winter, your ceiling fan should rotate clockwise at low speed. This pulls cool air up which pushes the warmer air near your ceiling down along your walls and back to the floor, making your room feel warmer.

-

Don’t forget to clean out your gutters! Check your gutters for debris after the trees lose most of their leaves to assure for good drainage of melting water during the coming winter months. Check your roof for missing shingles, possible leaks etc.

We hope you have found these tips helpful! Check with Bieritz Agency for all your insurance needs. Call us for a free quote – we can save you money!

Bieritz Insurance Agency, is proud to offer two convenient locations in Otsego County.

Your “Hometown” Insurance Specialists!

HOME • AUTO • BUSINESS • LIFE • FARM • BOAT • CYCLE & MORE

Bieritz Insurance Agency

209 Main Street

Cooperstown, NY 13326

607-547-2951

FAX 607-547-4487

info@bieritzinsurance.com

Morris Insurance Agency

128 Main Street

P.O. Box 70

Morris, NY 13808

607-263-5170

FAX 607-263-5270

agent@morrisinsuranceny.com

Understanding 5 Types of Car Insurance Coverage

A nice concise video covering auto insurance from First Quote Insurance. Please contact our team if you have any questions!