If your child is leaving home to attend college, make sure you check with your auto insurance

If your child is leaving home to attend college, make sure you check with your auto insurance

provider to see if there are any updates required to maintain your policy because of this change.

It is not recommended to drop a college student from your policy when they leave for school for several reasons. First, continuous coverage will benefit your child when they are no longer listed on your policy and purchase coverage on their own. Second, your child may need to drive when they return home during school breaks or if they drive a friend’s car while at school. Third, having your child listed for coverage on your policy protects your child in the event of any auto-related accident while they are away, as a driver, passenger or pedestrian.

Some companies also offer discounts for your full-time college student drivers. If your child maintains a grade average of 3.0 or higher, you can provide a transcript and submit for consideration. You may also qualify for a discount if your child is attending college 75 miles or more away from home.

Students who are taking a car that you own to school can remain on your policy (likely less expensive than under their own policy as a young driver), but you should notify your insurance company of the new address where the vehicle will be located. If it is in a less populated area, you might end up with a lower rate. If your student is traveling with their vehicle out of state, make sure your current policy meets the minimum insurance requirements for that state. If your student owns the vehicle and holds the title, it is likely that they will need to obtain their own insurance.

If you have a student that is attending college and you have questions about their Auto Insurance, call us today at 607-547-2951 in Cooperstown or in Morris at 607-263-5170.

How to Protect Yourself and Your Guests

- Make sure you understand your state laws. Before sending out party invitations, familiarize yourself with your state’s social host liability laws. These laws vary widely from state to state. Some states do not impose any liability on social hosts. Others limit liability to injuries that occur on the host’s premises. Some extend the host’s liability to injuries that occur anywhere a guest who has consumed alcohol goes. Many states have laws that pertain specifically to furnishing alcohol to minors.

- Consider venues other than your home for the party. Hosting your party at a restaurant or bar with a liquor license, rather than at your home, will help minimize liquor liability risks.

- Hire a professional bartender. Most bartenders are trained to recognize signs of intoxication and are better able to limit consumption by partygoers.

- Encourage guests to pick a designated driver who will refrain from drinking alcoholic beverages so that he or she can drive other guests home.

- Be a responsible host/hostess. Limit your own alcohol intake so that you will be better able to judge your guests’ sobriety.

- Offer non-alcoholic beverages and always serve food. Eating and drinking plenty of water, or other non-alcoholic beverages, can help counter the effects of alcohol.

- Do not pressure guests to drink or rush to refill their glasses when empty. And never serve alcohol to guests who are visibly intoxicated.

- Stop serving liquor toward the end of the evening. Switch to coffee, tea and soft drinks.

- If guests drink too much or seem too tired to drive home, call a cab, arrange a ride with a sober guest or have them sleep at your home.

- Encourage all your guests to wear seatbelts as they drive home. Studies show that seatbelts save lives.

: Complete the form below and click Submit.

: Complete the form below and click Submit. Your homeowners insurance policy covers your property, but if you store your property off your site at a storage facility or self-storage unit, do you need additional protection? In the case of natural disasters like flood, or tornado, the facility is not likely legally responsible for your belongings.

Your homeowners insurance policy covers your property, but if you store your property off your site at a storage facility or self-storage unit, do you need additional protection? In the case of natural disasters like flood, or tornado, the facility is not likely legally responsible for your belongings.

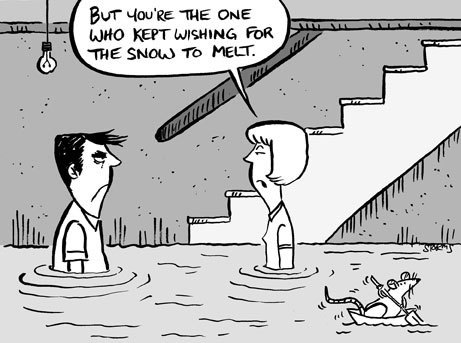

If you find yourself as host to a large gathering this weekend for Superbowl Sunday, this article has some great information about Social Host Liability.

If you find yourself as host to a large gathering this weekend for Superbowl Sunday, this article has some great information about Social Host Liability. From the student’s perspective, a driver’s license represents some very big things: freedom (the ability to go where you want, when you want); independence (not having to depend on parents or others to get there); responsibility (for ones’ self, for passengers, for a car, for gas, for others on the roadways). The driver’s license is one of the milestones in the transition from youth to adult.

From the student’s perspective, a driver’s license represents some very big things: freedom (the ability to go where you want, when you want); independence (not having to depend on parents or others to get there); responsibility (for ones’ self, for passengers, for a car, for gas, for others on the roadways). The driver’s license is one of the milestones in the transition from youth to adult. Social media is a great way to stay in touch with friends and family from all over the world, but privacy settings only go so far to limit what people can see and learn about you. Although this is not a new topic, we just want to remind our friends, clients and families to please be careful with the information that you share on your social networks.

Social media is a great way to stay in touch with friends and family from all over the world, but privacy settings only go so far to limit what people can see and learn about you. Although this is not a new topic, we just want to remind our friends, clients and families to please be careful with the information that you share on your social networks.