Snowmobiling is a popular winter activity, offering a fun and exciting way to explore the great outdoors. However, snowmobiling can also be dangerous, especially in challenging weather conditions. To help keep you safe on your next snowmobiling adventure, we’ve put together a guide to winter snowmobile safety, including tips and best practices for staying safe on the trails.

Preparation Before You Ride

Before you hit the trails, it’s important to make sure you’re properly prepared for your snowmobile ride. Here are some tips for getting ready for your snowmobile adventure:

- Check the weather. Before you go snowmobiling, check the weather forecast to make sure you’re prepared for any conditions you may encounter on the trails.

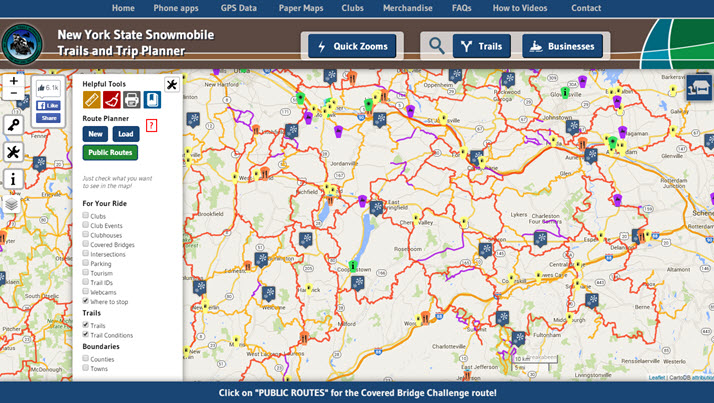

- Plan your route. Plan your route in advance, taking into account any obstacles or hazards you may encounter. Make sure to let someone know where you’re going and when you expect to return.

- Dress appropriately. Dress in layers and make sure to wear appropriate clothing, such as a helmet, gloves, and boots, to stay warm and protected while snowmobiling.

- Check your equipment. Make sure your snowmobile is in good working condition before you go, checking the brakes, lights, and other systems to make sure everything is in order.

- Get trained. Take a snowmobile safety course to learn best practices for operating a snowmobile and to improve your skills on the trails.

During Your Ride

When you’re on the trails, it’s important to follow best practices for snowmobile safety to reduce the risk of accidents and incidents. Here are some tips for staying safe while snowmobiling:

- Follow the rules of the trail. Follow the rules of the trail and stay on designated snowmobile trails to reduce the risk of accidents and incidents.

- Stay aware of your surroundings. Pay attention to your surroundings, including other snowmobiles, trees, and other obstacles, to avoid potential hazards.

- Drive defensively. Drive defensively, allowing plenty of space between you and other snowmobiles, and being prepared for other drivers to make sudden moves.

- Take it slow. When you’re on the trails, take it slow and be cautious, especially in challenging weather conditions.

- Avoid alcohol. Avoid alcohol when snowmobiling, as it can impair your judgment and increase the risk of accidents and incidents.

If you Encounter an Emergency

Despite your best efforts, accidents and incidents can still occur while snowmobiling. If you encounter an emergency, here are some tips for staying safe:

- Stay calm. If you encounter an emergency, stay calm and assess the situation.

- Get to safety. If possible, get to a safe location and call for help.

- Know your location. Make sure you know your location and have a way to communicate your location to first responders.

- Stay warm. If you’re stranded, make sure to stay warm and dry, as hypothermia can be a serious risk in cold weather conditions.

Snowmobiling is a popular winter activity, offering a fun and exciting way to explore the great outdoors. However, it’s important to follow best practices for winter snowmobile safety to reduce the risk of accidents and incidents. By preparing before you ride, following safety tips while snowmobiling, and being prepared for emergencies, you can have a safe and enjoyable snowmobiling experience. So, make sure to follow these tips to stay safe and have a great time on the trails this winter!

The summer months are ones we look forward to all year long, but they bring certain risks along with the great summer weather. After our long, cold, winter months, we are all more than ready to be outdoors and enjoying fun times with family and friends. To minimize your risks, you can do a quick insurance protection check to make sure you are ready for the summer months.

The summer months are ones we look forward to all year long, but they bring certain risks along with the great summer weather. After our long, cold, winter months, we are all more than ready to be outdoors and enjoying fun times with family and friends. To minimize your risks, you can do a quick insurance protection check to make sure you are ready for the summer months. Outdoor recreation activities over the past few years (since the onset of COVID-19) has boomed with people throughout the U.S. looking for safe spaces with fresh air and good opportunities for socially distanced recreation. Here in New York, there are parts of the Catskills that were inundated with so many people, trails were closed in order to protect them from foot traffic. This surge in interest in outdoor activities has also spurred increased visitation at National Parks throughout the country. Those numbers continued to increase in 2021 – with close to 300 million visits and record high numbers in forty-four parks.

Outdoor recreation activities over the past few years (since the onset of COVID-19) has boomed with people throughout the U.S. looking for safe spaces with fresh air and good opportunities for socially distanced recreation. Here in New York, there are parts of the Catskills that were inundated with so many people, trails were closed in order to protect them from foot traffic. This surge in interest in outdoor activities has also spurred increased visitation at National Parks throughout the country. Those numbers continued to increase in 2021 – with close to 300 million visits and record high numbers in forty-four parks. It’s the time of year when our snow-loving neighbors venture forth on wintery trails throughout our region. According to the International Snowmobile Manufacturers Association, in 2021, there were over 1.3 billion snowmobiles registered in the U.S. – over 100,000 of these are in New York State. New York offers thousands of miles of snowmobile trails that wind their way through some of the most beautiful and scenic parts of the state including the Catskill Mountains and the Adirondacks.

It’s the time of year when our snow-loving neighbors venture forth on wintery trails throughout our region. According to the International Snowmobile Manufacturers Association, in 2021, there were over 1.3 billion snowmobiles registered in the U.S. – over 100,000 of these are in New York State. New York offers thousands of miles of snowmobile trails that wind their way through some of the most beautiful and scenic parts of the state including the Catskill Mountains and the Adirondacks.

Here is an overview of some of the most frequently asked questions about motorcycle insurance.

Here is an overview of some of the most frequently asked questions about motorcycle insurance.

One of the small joys of the summer season for adults and children alike is being able to go swimming. Cooling off in the water offers relief from the heat and humidity. If you are looking for the convenience and benefits of having your own backyard pool, don’t forget to consider the added cost of insurance into your expenses.

One of the small joys of the summer season for adults and children alike is being able to go swimming. Cooling off in the water offers relief from the heat and humidity. If you are looking for the convenience and benefits of having your own backyard pool, don’t forget to consider the added cost of insurance into your expenses.  We understand that, with summer right around the corner and water temperatures sure to be rising, you want to get back out on that water fast. While the draws of Glimmerglass and other bodies of water are many, your safety is nothing to be hasty about, and so here we provide 5 things to consider when buying boat insurance.

We understand that, with summer right around the corner and water temperatures sure to be rising, you want to get back out on that water fast. While the draws of Glimmerglass and other bodies of water are many, your safety is nothing to be hasty about, and so here we provide 5 things to consider when buying boat insurance.  Snowmobiling is

Snowmobiling is  Outdoor fire pits have become an increasingly popular outdoor home accessory. If you have a fire pit or are considering adding one to your yard, here are a few things you should think about for safety.

Outdoor fire pits have become an increasingly popular outdoor home accessory. If you have a fire pit or are considering adding one to your yard, here are a few things you should think about for safety.

If you find yourself as host to a large gathering this weekend for Superbowl Sunday, this article has some great information about Social Host Liability.

If you find yourself as host to a large gathering this weekend for Superbowl Sunday, this article has some great information about Social Host Liability. After a long winter, we bet you are more than ready for summer and all of the things you can do to take advantage of the warmer weather. The pool is open and your boat or jetski is in the water, all ready to enjoy for the season. Think for a moment and consider your insurance. Are you prepared for the possibility of an accident?

After a long winter, we bet you are more than ready for summer and all of the things you can do to take advantage of the warmer weather. The pool is open and your boat or jetski is in the water, all ready to enjoy for the season. Think for a moment and consider your insurance. Are you prepared for the possibility of an accident? For property damage, estimate the value of each item and how much you would lose without insurance. For items like an RV or a boat, this can be a considerable loss. You can choose a high liability limit and add an umbrella policy to your coverage. For liability, you can add extra coverage to your homeowner’s policy or include summer items on an umbrella policy to extend your liability coverage. Each carrier is different with what summer toys can be included, so be sure to check to make sure each addition is allowed.

For property damage, estimate the value of each item and how much you would lose without insurance. For items like an RV or a boat, this can be a considerable loss. You can choose a high liability limit and add an umbrella policy to your coverage. For liability, you can add extra coverage to your homeowner’s policy or include summer items on an umbrella policy to extend your liability coverage. Each carrier is different with what summer toys can be included, so be sure to check to make sure each addition is allowed. For items that carry significant risks, like trampolines, check with your carrier to make sure this coverage is allowed or included on your homeowner’s policy. Some carriers prefer not to absorb the risks associated with trampolines and may cancel or decline to renew your policy if they learn you have one on your property.

For items that carry significant risks, like trampolines, check with your carrier to make sure this coverage is allowed or included on your homeowner’s policy. Some carriers prefer not to absorb the risks associated with trampolines and may cancel or decline to renew your policy if they learn you have one on your property.