Protecting Your Loved Ones Today and Tomorrow

When you’re a young parent, life is a whirlwind of diapers, first steps, and sleepless nights. Amid the chaos and joy of raising a family, one important consideration that often gets overlooked is life insurance. It’s easy to assume that life insurance is something you can put off until later in life, but the reality is that it’s essential, especially for young families. In this article, we’ll explore why life insurance is crucial for young families and provide guidance on choosing the right policy to protect your loved ones today and tomorrow.

When you’re a young parent, life is a whirlwind of diapers, first steps, and sleepless nights. Amid the chaos and joy of raising a family, one important consideration that often gets overlooked is life insurance. It’s easy to assume that life insurance is something you can put off until later in life, but the reality is that it’s essential, especially for young families. In this article, we’ll explore why life insurance is crucial for young families and provide guidance on choosing the right policy to protect your loved ones today and tomorrow.

Why Life Insurance Matters for Young Families

1. Financial Protection

The primary purpose of life insurance is to provide financial protection for your loved ones in case of your untimely death. It ensures that your family has the financial resources they need to maintain their quality of life, pay for ongoing expenses, and achieve future financial goals, even in your absence.

2. Covering Immediate Expenses

Life insurance can cover immediate expenses that arise after your passing. This includes funeral and burial costs, medical bills, and any outstanding debts. Without life insurance, your family may struggle to meet these financial obligations during an already emotionally challenging time.

3. Replacing Lost Income

For most young families, a significant portion of their financial security depends on the income of one or both parents. If one spouse passes away, the loss of that income can be devastating. Life insurance can replace lost income, ensuring that your family can continue to meet their financial needs.

4. Providing for Your Children’s Future

Life insurance can fund your children’s education and provide for their future needs. Whether it’s paying for college tuition, helping them buy their first home, or providing financial support as they start their own families, life insurance ensures that your children have the opportunities they deserve.

5. Paying Off Debts and Mortgages

Life insurance can be used to pay off outstanding debts and mortgages. This helps your family avoid the burden of debt payments and allows them to keep their home, even if they face financial challenges after your passing.

Choosing the Right Life Insurance for Your Family

Now that you understand why life insurance is essential for young families, let’s explore how to choose the right policy:

1. Determine Your Coverage Needs

The first step in selecting life insurance is determining how much coverage you need. Consider your family’s financial obligations, including mortgage payments, monthly bills, and future expenses like education. A common rule of thumb is to have coverage that’s at least 10-15 times your annual income.

2. Choose the Right Type of Policy

There are two primary types of life insurance: term life and permanent life.

- Term Life Insurance: Term life insurance provides coverage for a specified term, such as 10, 20, or 30 years. It’s often more affordable and ideal for young families looking for cost-effective coverage during their peak earning years.

- Permanent Life Insurance: Permanent life insurance, which includes whole life and universal life, provides coverage for your entire life and includes a cash value component. While it’s more expensive, it can serve as a long-term financial asset and estate planning tool.

Consider your family’s needs and budget when deciding between term and permanent life insurance.

3. Calculate Premiums and Budget

Get quotes from multiple insurance providers to calculate premiums for different coverage amounts and policy types. Determine how much you can comfortably budget for life insurance premiums, keeping in mind that affordable term life insurance can provide substantial coverage.

4. Review Policy Riders

Life insurance policies often offer additional riders that can enhance your coverage. Common riders include:

- Waiver of Premium: This rider allows you to stop paying premiums if you become disabled and are unable to work.

- Child Rider: Provides coverage for your children’s life insurance needs.

- Accelerated Death Benefit: Allows you to access a portion of your policy’s death benefit if you’re diagnosed with a terminal illness.

Evaluate whether these riders are beneficial for your family and consider adding them to your policy if they align with your needs.

5. Work with a Reputable Agent

Consulting with an experienced and reputable insurance agent can be invaluable when choosing the right life insurance policy. An agent can help you navigate the complexities of life insurance, provide personalized recommendations, and ensure that you fully understand the policy you’re purchasing.

6. Review and Update Regularly

Life insurance needs can change over time due to factors such as family size, income, and financial goals. It’s essential to review your life insurance policy regularly, especially after major life events like the birth of a child or a change in income. Adjust your coverage as needed to ensure that it continues to meet your family’s needs.

Life insurance is a vital component of financial planning for young families. It provides the peace of mind that comes with knowing your loved ones will be financially secure even if the unexpected occurs. By determining your coverage needs, selecting the right policy type, and working with a trusted agent, you can secure the financial future of your family and ensure that your children have the opportunities they deserve. Don’t delay—take the necessary steps to protect your family today and tomorrow with the right life insurance coverage. For more information or to find a policy that is right for you, contact our team at 607-547-2951.

It’s called Life Insurance, but it could just as easily be labeled Love Insurance. Buying life insurance is really an expression of love. It lets loved ones know that you care so much that you’ve made plans to provide for their well-being…even after you’re gone.

It’s called Life Insurance, but it could just as easily be labeled Love Insurance. Buying life insurance is really an expression of love. It lets loved ones know that you care so much that you’ve made plans to provide for their well-being…even after you’re gone.

Explore Part-Time Employment:

Explore Part-Time Employment: One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics.

One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics. Life insurance is a necessity for most adults. Protecting and providing for your family is important should something happen to you. With how drastically our world has changed over the past few months, you may wonder if the life insurance industry has shifted as well.

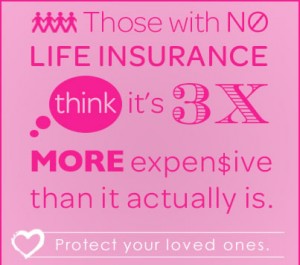

Life insurance is a necessity for most adults. Protecting and providing for your family is important should something happen to you. With how drastically our world has changed over the past few months, you may wonder if the life insurance industry has shifted as well. When you are looking to protect yourself and your family, you need to consider life insurance. Life insurance is the financial security net that helps your family get through a rough time. But, when shopping for life insurance coverage there are several factors that can impact your premiums. These factors can include your age and gender. A carrier will also take into consideration not only your health history but your family’s. The carrier may also look at what you do for your career and your hobbies. Your choice in your insurance coverage also affects your premium.

When you are looking to protect yourself and your family, you need to consider life insurance. Life insurance is the financial security net that helps your family get through a rough time. But, when shopping for life insurance coverage there are several factors that can impact your premiums. These factors can include your age and gender. A carrier will also take into consideration not only your health history but your family’s. The carrier may also look at what you do for your career and your hobbies. Your choice in your insurance coverage also affects your premium.

Life insurance isn’t a sexy topic, but at some point, it is one that most people have to think about. The question of what happens to your family in the event of your death is an important one to consider. This comes about sometimes after significant life status events – perhaps a marriage, the birth of a child or purchasing a home. Life insurance helps protect your loved ones in the event of your death. It can cover your funeral expenses, pay off your mortgage or provide resources to replace your income for a period of time. Two of the more prevalent types of life insurance are term life and whole life. Knowing a bit about the differences between these two types of insurance can help you to decide which might be the best product for your needs.

Life insurance isn’t a sexy topic, but at some point, it is one that most people have to think about. The question of what happens to your family in the event of your death is an important one to consider. This comes about sometimes after significant life status events – perhaps a marriage, the birth of a child or purchasing a home. Life insurance helps protect your loved ones in the event of your death. It can cover your funeral expenses, pay off your mortgage or provide resources to replace your income for a period of time. Two of the more prevalent types of life insurance are term life and whole life. Knowing a bit about the differences between these two types of insurance can help you to decide which might be the best product for your needs.

Bieritz Insurance Agency is an independent agency working with over 20 companies to offer our customers a variety of options, and find the right product and company to fit your needs. We operate in the beautiful Leatherstocking Region of Central New York and are proud to call the Cooperstown Area our home. We are an Award Winning Allstate Independent Agency, having received recognition for being among the top 30 Independent agents in the United States. Contact us at (607) 547-2951, 209 Main Street, Cooperstown or (607) 263-5170, 128 Main Street, Morris.

Bieritz Insurance Agency is an independent agency working with over 20 companies to offer our customers a variety of options, and find the right product and company to fit your needs. We operate in the beautiful Leatherstocking Region of Central New York and are proud to call the Cooperstown Area our home. We are an Award Winning Allstate Independent Agency, having received recognition for being among the top 30 Independent agents in the United States. Contact us at (607) 547-2951, 209 Main Street, Cooperstown or (607) 263-5170, 128 Main Street, Morris.