A Fresh Start for Your Home and Your Wallet

As the days grow longer and temperatures rise, spring is the perfect time to breathe new life into your home. While the idea of spring cleaning often conjures images of dusting, decluttering, and organizing, it’s also an opportunity to enhance your home’s safety and potentially save on your home insurance. In this article, we’ll explore ways homeowners can declutter, make their homes safer, and reduce insurance risks, all while potentially leading to insurance savings.

The Connection Between Spring Cleaning and Home Insurance Savings

At first glance, spring cleaning and home insurance might seem unrelated. However, a well-maintained and organized home can significantly impact your home insurance premiums and coverage. Here’s how:

At first glance, spring cleaning and home insurance might seem unrelated. However, a well-maintained and organized home can significantly impact your home insurance premiums and coverage. Here’s how:

1. Reduced Risk of Accidents

A cluttered home is more prone to accidents, such as trips and falls. By decluttering and organizing, you create a safer living environment, reducing the risk of injuries that could lead to insurance claims.

2. Improved Home Security

Spring cleaning often involves assessing your home’s security. Installing or updating security measures like deadbolt locks, window locks, and security systems can lower the risk of theft or vandalism, potentially leading to lower insurance premiums.

3. Prevention of Water Damage

Inspecting and maintaining your home’s plumbing and drainage systems during spring cleaning can help identify and address issues before they become major problems. This proactive approach can prevent water damage claims and related premium increases.

4. Proper Fire Safety

Spring cleaning is an excellent time to check and maintain smoke detectors, fire extinguishers, and heating systems. A home equipped with adequate fire safety measures can result in insurance discounts.

5. Home Renovations and Updates

If you plan to undertake any home renovations or updates during spring cleaning, such as replacing the roof or upgrading electrical systems, you may be eligible for insurance discounts based on the improved condition and safety of your home.

Spring Cleaning Tips for Home Insurance Savings

Here are practical spring cleaning tips to help you create a safer and more organized home while potentially leading to insurance savings:

1. Declutter and Organize

- Safety First: Remove clutter, especially in high-traffic areas, to reduce the risk of trips and falls.

- Storage Solutions: Invest in storage solutions like shelving units, bins, and cabinets to keep items organized and out of the way.

2. Home Security

- Evaluate Locks: Inspect and upgrade locks on doors and windows if necessary to improve home security.

- Security Systems: Consider installing or upgrading to a home security system with monitoring services, which can lead to insurance discounts.

3. Plumbing and Drainage

- Inspect for Leaks: Look for signs of leaks or water damage in bathrooms, kitchens, and basements.

- Clean Gutters: Ensure gutters and downspouts are clear to prevent water buildup on the roof and potential leaks.

4. Fire Safety

- Check Smoke Detectors: Test smoke detectors and replace batteries if needed.

- Fire Extinguishers: Make sure fire extinguishers are accessible and have not expired.

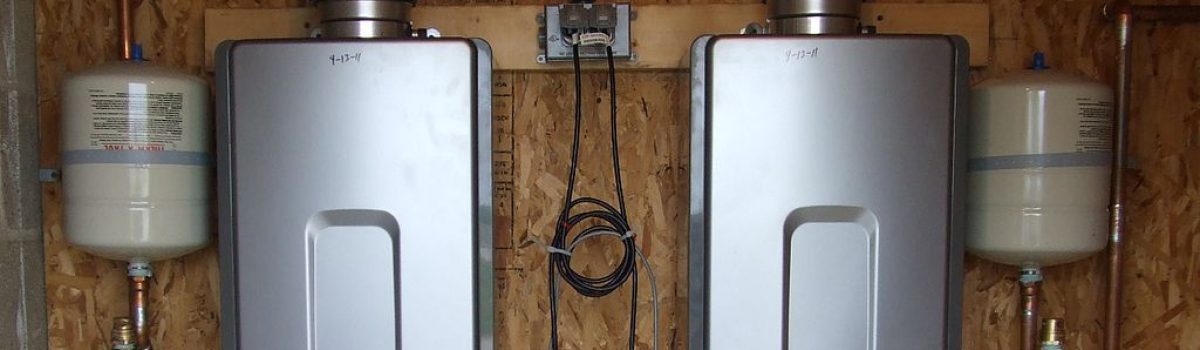

- Heating Systems: Have heating systems serviced to ensure they are functioning safely and efficiently.

5. Home Renovations and Updates

- Roof Inspection: If your roof is due for replacement, consider upgrading to impact-resistant roofing materials that may qualify for insurance discounts.

- Electrical Updates: Address any electrical issues or consider upgrading to a modern electrical system, which can reduce fire risks.

6. Review Your Insurance Policy

As you clean and update your home, take the opportunity to review your home insurance policy. Ensure it accurately reflects your home’s features, such as security systems or recent renovations. Discuss potential discounts or adjustments with your insurance provider based on the improvements you’ve made.

7. Bundle Your Insurance Policies

Consider bundling your home insurance with other insurance policies you may have, such as auto insurance. Many insurance companies offer multi-policy discounts.

Benefits Beyond Insurance Savings

While the potential for insurance savings is a compelling reason to engage in spring cleaning and home improvements, there are additional benefits:

- Enhanced Quality of Life: A well-organized and maintained home is more comfortable and enjoyable to live in.

- Peace of Mind: Knowing that your home is safer and less prone to accidents can provide peace of mind for you and your family.

- Increased Property Value: Home improvements can increase the value of your property, which can be advantageous when selling or refinancing your home.

Conclusion

Spring cleaning is not just about tidying up; it’s an opportunity to create a safer, more organized, and more efficient living environment. By addressing safety concerns, improving security, and maintaining your home’s vital systems, you not only reduce the risk of accidents and damage but also potentially save on your home insurance. Take advantage of this season of renewal to invest in your home’s safety and security, providing peace of mind for you and your loved ones while enjoying potential insurance savings. For a free quote on your insurance, call our team at 607-547-2951.

Accidents and incidents can happen at any time, but taking precautions and being prepared can help reduce the risk. Whether you’re at home or on the road, there are many steps you can take to stay safe and lower your insurance premiums. In this article, we’ll provide helpful tips for reducing the risk of accidents and incidents in the home and on the road, and show how these tips can help lower insurance premiums.

Accidents and incidents can happen at any time, but taking precautions and being prepared can help reduce the risk. Whether you’re at home or on the road, there are many steps you can take to stay safe and lower your insurance premiums. In this article, we’ll provide helpful tips for reducing the risk of accidents and incidents in the home and on the road, and show how these tips can help lower insurance premiums. Finding the right person to work with you on your home improvements can be a challenge. In our region, it is an industry where very few have websites to provide helpful information about who they are, how long they have been in business or examples of their work. Instead, much of our connection with potential businesses comes through social media posts and referrals.

Finding the right person to work with you on your home improvements can be a challenge. In our region, it is an industry where very few have websites to provide helpful information about who they are, how long they have been in business or examples of their work. Instead, much of our connection with potential businesses comes through social media posts and referrals. When embarking on home improvement projects, one of the first decisions is whether to do it yourself or to hire a professional. If you feel you have the skillset to undertake a particular project, then it might make sense to proceed with it. If you are not sure, remember that time is valuable – and if you make a mistake, you may likely have to do all the work over again or possibly end up calling a professional anyway. Make sure you consider your ‘worst case scenario’ and let that help guide you in your decision.

When embarking on home improvement projects, one of the first decisions is whether to do it yourself or to hire a professional. If you feel you have the skillset to undertake a particular project, then it might make sense to proceed with it. If you are not sure, remember that time is valuable – and if you make a mistake, you may likely have to do all the work over again or possibly end up calling a professional anyway. Make sure you consider your ‘worst case scenario’ and let that help guide you in your decision. Living in a classic old house is a privilege. Older homes can evoke a sense of beauty, love, charisma. They have a level of character and craftsmanship that are no longer seen in todays modern houses. However, during the cold winters, an older home can be quite uncomfortable. If you are looking into insulation, you may find the information here to be helpful.

Living in a classic old house is a privilege. Older homes can evoke a sense of beauty, love, charisma. They have a level of character and craftsmanship that are no longer seen in todays modern houses. However, during the cold winters, an older home can be quite uncomfortable. If you are looking into insulation, you may find the information here to be helpful.  Most people know that there are some logical ways to save money on their insurance. Bundling your auto and homeowners insurance with one carrier and agency can qualify you for a discount. You can use higher deductibles or drop some of your coverage levels. You can take driving safety courses or install security systems. These are all things that you can control and adjust as you need to. What you might not realize is that insurance pricing changes on a regular basis and is driven by many different factors. The general recommendation is to re-quote on your policies every 6-12 months.

Most people know that there are some logical ways to save money on their insurance. Bundling your auto and homeowners insurance with one carrier and agency can qualify you for a discount. You can use higher deductibles or drop some of your coverage levels. You can take driving safety courses or install security systems. These are all things that you can control and adjust as you need to. What you might not realize is that insurance pricing changes on a regular basis and is driven by many different factors. The general recommendation is to re-quote on your policies every 6-12 months. New York State is making a huge push to help homeowners and businesses transition out of fossil fuel dependence. Through

New York State is making a huge push to help homeowners and businesses transition out of fossil fuel dependence. Through

One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics.

One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics.

While buying a new house is certainly one of the most exciting things anyone can do, the actual process of getting into that house is often full of stress and hard work. Even when the sale has finally closed, you still have an incredibly daunting task ahead of you: moving. Some people choose to do it themselves; others hire professional help. Either way, it’s important to consider your valuable possessions, and what might happen to them during the move. No matter how careful you are, there’s always the risk that something bad can happen to these irreplaceable keepsakes. This is why it’s important to consider moving insurance.

While buying a new house is certainly one of the most exciting things anyone can do, the actual process of getting into that house is often full of stress and hard work. Even when the sale has finally closed, you still have an incredibly daunting task ahead of you: moving. Some people choose to do it themselves; others hire professional help. Either way, it’s important to consider your valuable possessions, and what might happen to them during the move. No matter how careful you are, there’s always the risk that something bad can happen to these irreplaceable keepsakes. This is why it’s important to consider moving insurance.

If you want to be energy efficient or stay warm on a budget, you are in luck. Keep reading to learn about ways to stay warm without increasing your energy bill or reinsulating your entire home.

If you want to be energy efficient or stay warm on a budget, you are in luck. Keep reading to learn about ways to stay warm without increasing your energy bill or reinsulating your entire home.