Today is Valentine’s Day, the second most popular gift and card-giving day of the year (Christmas is the first). It is a designated day to recognize the people we love and let them know how much they mean to us, often through tokens of affection, dinner, candy, flowers, etc. It is also the perfect time to think about Life Insurance.

It might not be the most romantic of thoughts, but making sure you are adequately insured provides financial protections for those you love. The emotional burden of losing a loved one is difficult enough – life insurance helps to make sure that financial concerns don’t add to that burden.

Life Insurance can be beneficial to everyone: single or married people; those with or without children; younger or older. It can be a means to cover funeral costs, medical expenses, to pay off existing debt or to provide income replacement. Everyone has different life insurance needs depending their individual situation and goals.

We can help answer your questions – Do you need it? If so, how much do you need? What are the different types of Life Insurance? How much does it cost? While you probably want to stick with the candy and flowers for today, tomorrow is a good time to take action if you are not currently insured.

Do it for Love.

Did you know…

Did you know your Life insurance policy can also help you pursue your savings goals? Video courtesy of Security Mutual:

Bieritz Insurance Agency is an independent agency working with over 20 companies to offer our customers a variety of options, and find the right product and company to fit your needs. We operate in the beautiful Leatherstocking Region of Central New York and are proud to call the Cooperstown Area our home. We are an Award Winning Allstate Independent Agency, having received recognition for being among the top 30 Independent agents in the United States. Contact us at (607) 547-2951, 209 Main Street, Cooperstown or (607) 263-5170, 128 Main Street, Morris.

Bieritz Insurance Agency is an independent agency working with over 20 companies to offer our customers a variety of options, and find the right product and company to fit your needs. We operate in the beautiful Leatherstocking Region of Central New York and are proud to call the Cooperstown Area our home. We are an Award Winning Allstate Independent Agency, having received recognition for being among the top 30 Independent agents in the United States. Contact us at (607) 547-2951, 209 Main Street, Cooperstown or (607) 263-5170, 128 Main Street, Morris.

Did you know…

Did you know…

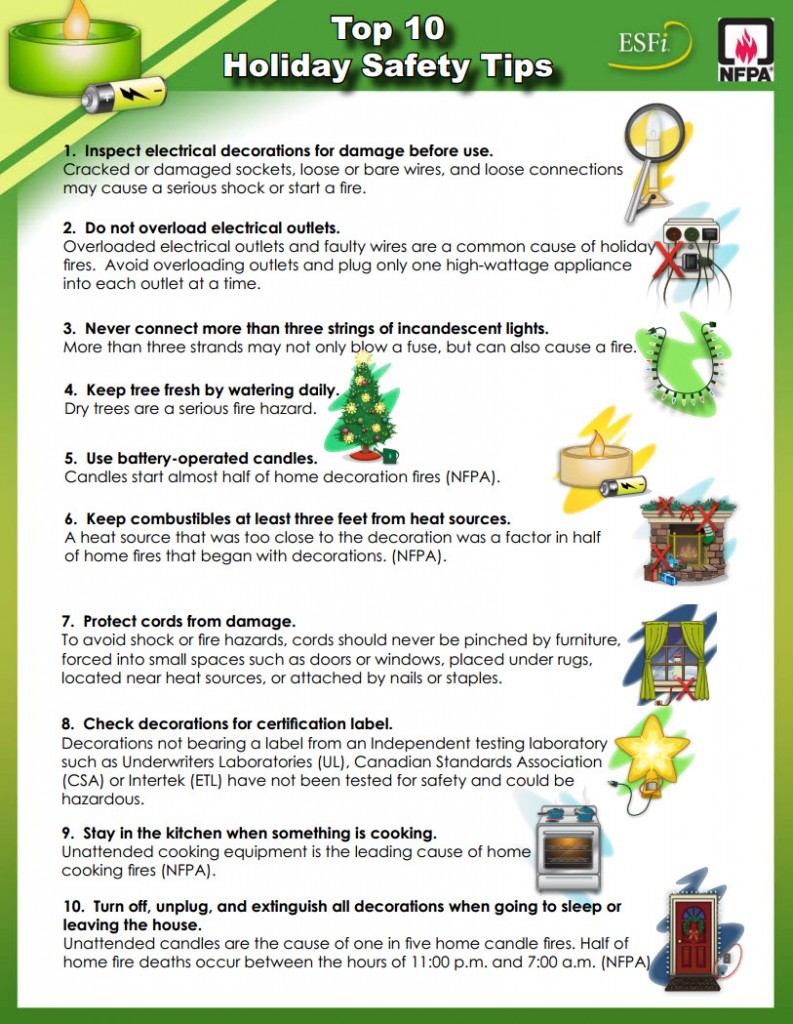

The Holiday Season marks a special time of the year, providing opportunities to gather with family and special friends. Whether you are hosting guests at your home or traveling to another destination, our team at Bieritz Insurance Agency would like to share some tips with you for a safe holiday season.

The Holiday Season marks a special time of the year, providing opportunities to gather with family and special friends. Whether you are hosting guests at your home or traveling to another destination, our team at Bieritz Insurance Agency would like to share some tips with you for a safe holiday season.

Sending a child off to college is a wonderful thing. It marks a new stage in their lives and allows for a new level of independence and real growth in learning to become responsible adults. Today’s student arrives at college with an array of personal belongings that help make them effective students and provide for comfortable living while away from home. In addition to clothing, furniture items, and books, they arrive at school with laptops, tablets, televisions, smartphones, printers, game consoles and more.

Sending a child off to college is a wonderful thing. It marks a new stage in their lives and allows for a new level of independence and real growth in learning to become responsible adults. Today’s student arrives at college with an array of personal belongings that help make them effective students and provide for comfortable living while away from home. In addition to clothing, furniture items, and books, they arrive at school with laptops, tablets, televisions, smartphones, printers, game consoles and more.