Do you need to purchase extra Rental Car Insurance on your trip?

Summer vacation travel season is here! If you are planning on heading out of town and using a rental car for your trip, you might find some of the information here helpful.

Summer vacation travel season is here! If you are planning on heading out of town and using a rental car for your trip, you might find some of the information here helpful.

Typically, when you are renting a car while on a personal vacation, your regular auto insurance policy will cover you for most of your needs. If you are traveling for business, your personal auto policy will not cover damage if you are renting for a business trip. If you have insurance for auto, renter or homeowner, you are likely already covered for liability, personal accident and personal effects coverage. The only coverage you might consider adding is additional collision damage insurance for a rental car. You can purchase this coverage to also include loss of use charges should a vehicle need to be repaired after an incident. This coverage can often be purchased through your private insurance provider for a minimal daily charge – far less than the upsell through a car rental agency.

If you are not covered by a private policy, you may be able to add rental car coverage through your major credit card account. Check with Visa, Mastercard, Discover and American Express through the phone numbers on the back of your cards. To receive the coverage through a credit card company, you must charge the entire rental on the credit card and decline the supplemental collision damage coverage offered by the rental company. It is important to note that you can’t have both. Coverage through the credit card company may have additional restrictions based on the length of the rental term, the type of vehicle you are renting, or what country you are renting from.

Another option is to purchase special travel insurance for your trip, to help cover your trip investment. Travel insurance helps to cover your trip investment if you have flight cancellations due to illness, injuries, weather incidents or other travel related issues. It can help you replace lost baggage, theft of property, tour operator bankruptcy, and more. Travel insurance also has the option for adding collision coverage for a rental vehicle as part of your vacation insurance package.

What rental car insurance can do is protect you from a surcharge on your policy premium for a claim on an accident when driving a rental car. It also can protect you from ‘loss of use’ charges when the rental car has to be off the road for repairs. If you are declining additional coverage, always make sure you take the time to read the fine print on your rental contract before signing for your vehicle, and make sure that it indicates that you are declining the additional insurance.

If you have any questions, check with our team at Bieritz Agency before your trip so we can help to advise you on what makes the most sense for you. We offer two convenient locations in Cooperstown and Morris.

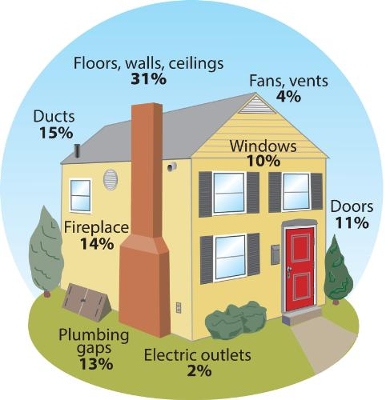

Spring is a great time of year to look around your home and decide on areas that could use a good refresh. Many homeowners keep a list of projects that they would like to do – now is the time to start crossing a few of those off your list! If you don’t have a list, but want to make some updates before the summer months, here are a few ideas for some outdoor and indoor projects. Some of these will depend on the amount of time and money you have to spend.

Spring is a great time of year to look around your home and decide on areas that could use a good refresh. Many homeowners keep a list of projects that they would like to do – now is the time to start crossing a few of those off your list! If you don’t have a list, but want to make some updates before the summer months, here are a few ideas for some outdoor and indoor projects. Some of these will depend on the amount of time and money you have to spend.

With just a little more than a month left for filing tax returns this year, it’s a good time to think about what things might qualify for an extra deduction. In addition to your mortgage and some loan interest payments, some of your 2015 household improvements might be deductible.

With just a little more than a month left for filing tax returns this year, it’s a good time to think about what things might qualify for an extra deduction. In addition to your mortgage and some loan interest payments, some of your 2015 household improvements might be deductible.

The expenses associated with maintaining your fireplace and chimney each year are minimal in comparison with the costs of a fire. We urge all our clients, family and friends to take the steps necessary to assure safe operations. If you have questions about your insurance coverage in the event of a fire, please contact our team in Cooperstown at 547-2951 or in Morris at 263-5170.

The expenses associated with maintaining your fireplace and chimney each year are minimal in comparison with the costs of a fire. We urge all our clients, family and friends to take the steps necessary to assure safe operations. If you have questions about your insurance coverage in the event of a fire, please contact our team in Cooperstown at 547-2951 or in Morris at 263-5170.

We have been very fortunate in our region this year to have not had any significant snowfall so far this winter. But, as we all know – those days are coming! Our favorite snow-shoveling days are the ones where each morning, there is only a tiny layer of new snow – light and powdery enough that all you need is a once over with a broom to sweep it clear. If we are lucky, we will have more than a few of those kinds of snowfalls this winter. Inevitably though, as part of the winter mix, we will end up with some accumulations of wetter snow that will require actual shoveling. Keep in mind some of the following safety tips for when this occurs.

We have been very fortunate in our region this year to have not had any significant snowfall so far this winter. But, as we all know – those days are coming! Our favorite snow-shoveling days are the ones where each morning, there is only a tiny layer of new snow – light and powdery enough that all you need is a once over with a broom to sweep it clear. If we are lucky, we will have more than a few of those kinds of snowfalls this winter. Inevitably though, as part of the winter mix, we will end up with some accumulations of wetter snow that will require actual shoveling. Keep in mind some of the following safety tips for when this occurs.  We take this opportunity to welcome Santa and Mrs. Claus back to their cottage on Pioneer Park this year. Come enjoy the spirit of Christmas in Cooperstown!

We take this opportunity to welcome Santa and Mrs. Claus back to their cottage on Pioneer Park this year. Come enjoy the spirit of Christmas in Cooperstown!

If your child is leaving home to attend college, make sure you check with your auto insurance

If your child is leaving home to attend college, make sure you check with your auto insurance