Homeowners insurance isn’t optional. If disaster strikes, without homeowners insurance you could be in severe financial trouble. In short, you don’t want to buy a house if you don’t plan on getting it protected from damage. But how exactly does homeowners insurance work and what should you look for when purchasing a new home that may raise your rates? Here are some things you need to know before finding a place to settle down.

Basic Facts About Homeowners Insurance

Homeowners insurance can seem a little daunting, but it’s actually pretty simple. These are the main things that homeowners insurance covers for you.

It helps you repair your home and other structures on your property

If your house is damaged or destroyed by, say, a fire or a hurricane, homeowners insurance will help you cover the cost of reconstruction, so you don’t have to break the bank trying to pay out of pocket. Also, homeowners insurance covers any structures you have on your property such as sheds, pools, swings, tree-houses, decks, lawns, etc. This way you can rest easy knowing that not only your house but features around it are protected in case of a disaster.

It helps you replace personal belongings

Most homeowner insurance policies not only cover your house but your personal belongings as well, such as furniture, TVs, jewelry, pretty much anything of monetary worth. Also, homeowners insurance doesn’t just cover valuable items from destruction in your house, but even outside your home. This means that if you lose a necklace in a hotel or the airport loses your luggage, your as protected as you would be if something was destroyed in your home.

It protects against liability

Homeowners insurance even covers some things you may not have thought of, but are just as important. For example, if someone gets hurt on your property–maybe your dog bites them, or they burn themselves on your stove, homeowners insurance can take care of any legal fees and medical expenses. Even if you accidentally hurt somebody away from your house, you’re still protected.

What Homeowners Insurance May not Automatically Cover

While there is a list of things that nearly all homeowner insurance policies cover, such as fires, thefts, hail, pipe bursts, explosions, and lighting, here are some things that most plans don’t cover.

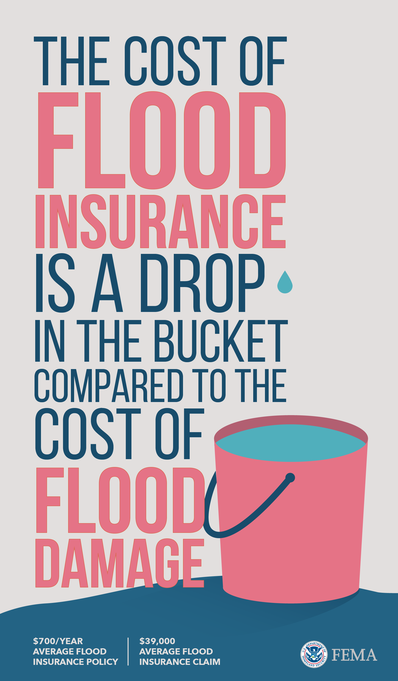

Floods and earthquakes

When people buy homeowners insurance, many take it as a given that damage from earthquakes and floods will be included in the policy. However, most plans don’t actually cover these natural disasters automatically. If you want them covered, you may need a separate policy. Also, depending on whether or not you live in a hurricane-prone location, your insurance may not cover hurricanes unless you specifically request that it be included, and then you will have to pay extra.

Gradual wear and tear

Insurance is designed more for sudden, unpredictable, large-scale disasters. That doesn’t include wear and tear that occurs over long periods of time such as damage from mold or termites. If you want to protect against things like this, make sure to pay attention to the general upkeep of your house.

Government action

If for any reason the government seizes your land or your property, homeowners insurance, unfortunately, won’t cover any expenses which may result.

What to Look for When Buying a New Home

Now that we’ve covered what homeowners insurance is, what it includes and what it doesn’t, here are some things which will impact the cost of your insurance that you should pay attention to when buying a new home.

What your home would cost to rebuild

Insurance agents are going to pay close attention to the age of your house and what it would cost to rebuild if it were to be destroyed. You should too. If your home is especially expensive to restore, it will probably mean you will be paying higher rates on your insurance policy. A particular house may catch your eye, but if it’s too costly to insure, it may not be worth the investment.

History of claims in your neighborhood

Another thing insurance agencies look for when creating your rates is how many claims are made in the area around your house. Since insurance companies naturally want to make as few payouts as possible, if your houses neighborhood is known for a high frequency of claims, it is going to show on your bill.

Things in or around your house which may be a risk

If your house has anything that may pose a risk of injury like a swing set or pool, your rate for coverage may go up. Since these things can be liabilities, insurance companies will often try to counteract them with higher premiums.

New homeowners have enough to worry about apart from insurance, however as anyone will tell you, it is not something that can be ignored. Fortunately, it’s not as complicated as it may seem. For more information, a quote, or to purchase insurance, contact our team at Bieritz Insurance.

This might be a little far fetched but it is wise to consider the risks when you allow someone to hunt on your property

This might be a little far fetched but it is wise to consider the risks when you allow someone to hunt on your property How do you know if you have a high risk pet that will affect either your ability to get insurance or the cost of your current homeowners policy? Insurance companies consider certain dog breeds to be high risk because these breeds tend to be more aggressive and are therefore deemed to be more dangerous:

How do you know if you have a high risk pet that will affect either your ability to get insurance or the cost of your current homeowners policy? Insurance companies consider certain dog breeds to be high risk because these breeds tend to be more aggressive and are therefore deemed to be more dangerous: It’s always an exciting time when your child graduates high school and begins a new career as a college student. Parents often face a mixture of emotions as they watch their children transition from high school to college. On one hand, your student has worked hard to graduate, and is stepping into a new life. One the other, that life is often away from the comforts and familiar faces of their hometown. Bieritz Insurance understands this is both an exciting and sometimes challenging time in the lives of both the students and the parents, and wants to help add an extra sense of security for both.

It’s always an exciting time when your child graduates high school and begins a new career as a college student. Parents often face a mixture of emotions as they watch their children transition from high school to college. On one hand, your student has worked hard to graduate, and is stepping into a new life. One the other, that life is often away from the comforts and familiar faces of their hometown. Bieritz Insurance understands this is both an exciting and sometimes challenging time in the lives of both the students and the parents, and wants to help add an extra sense of security for both.  Summer. It’s the time of year when the days are long and hot. The kids are out of school and nothing seems like a better idea than hanging out around the pool with your family, hosting backyard bbq parties, and enjoying those extra hours of sunshine. It’s not surprising, then, that many homeowners turn their eyes to their own backyards to contemplate the addition of a pool to their property. Homeowners that already have a pool installed will spend time cleaning and prepping the area in anticipation of summer parties and get togethers. Whether you have a pool or are planning to install one, here are some safety tips to help you enjoy it more and worry less.

Summer. It’s the time of year when the days are long and hot. The kids are out of school and nothing seems like a better idea than hanging out around the pool with your family, hosting backyard bbq parties, and enjoying those extra hours of sunshine. It’s not surprising, then, that many homeowners turn their eyes to their own backyards to contemplate the addition of a pool to their property. Homeowners that already have a pool installed will spend time cleaning and prepping the area in anticipation of summer parties and get togethers. Whether you have a pool or are planning to install one, here are some safety tips to help you enjoy it more and worry less. In our little corner of the world, the vacation rental business is booming. While year-round lodging opportunities (hotels, motels, bed and breakfasts, inns, etc.) continue to exist as a mainstay of accommodation options in our area – there are many properties that now cater mostly to the thirteen week summer season – primarily targeted to the baseball camp family audience for weekly rentals. Some of these properties contract with local managers to list and rent their homes as summer vacation rentals and others (more each day) list with one or more of the national rental chains like HomeAway, VRBO (Vacation Rental By Owner) or AirB&B.

In our little corner of the world, the vacation rental business is booming. While year-round lodging opportunities (hotels, motels, bed and breakfasts, inns, etc.) continue to exist as a mainstay of accommodation options in our area – there are many properties that now cater mostly to the thirteen week summer season – primarily targeted to the baseball camp family audience for weekly rentals. Some of these properties contract with local managers to list and rent their homes as summer vacation rentals and others (more each day) list with one or more of the national rental chains like HomeAway, VRBO (Vacation Rental By Owner) or AirB&B.

Every old house homeowner knows there are time of the year when they find some unexpected house guests. When the weather warms in the spring and summer months, the small trails of ants might appear in your kitchen, and in the fall months, as the weather cools, there are sometimes little creepers that find their way into your pantry.

Every old house homeowner knows there are time of the year when they find some unexpected house guests. When the weather warms in the spring and summer months, the small trails of ants might appear in your kitchen, and in the fall months, as the weather cools, there are sometimes little creepers that find their way into your pantry. One of the small joys of the summer season for adults and children alike is being able to go swimming. Cooling off in the water offers relief from the heat and humidity. If you are looking for the convenience and benefits of having your own backyard pool, don’t forget to consider the added cost of insurance into your expenses.

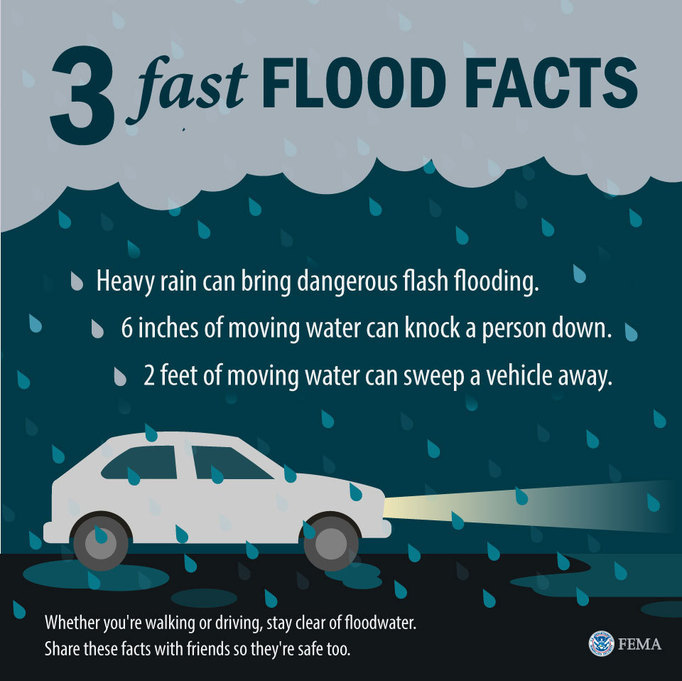

One of the small joys of the summer season for adults and children alike is being able to go swimming. Cooling off in the water offers relief from the heat and humidity. If you are looking for the convenience and benefits of having your own backyard pool, don’t forget to consider the added cost of insurance into your expenses.  Spring is here and with the season’s change comes the rain. It seems that we have had a good deal of precipitation just over the last two weeks in our region – and if you are looking at our local rivers and streams, we are noticing that the water is running fast and high. Floods happen everywhere – they are not relegated to specific regions like tornadoes or hurricanes. Our area has certainly had more than a few years over this last decade where flooding has been severe. For safety, please keep an ear out for warnings and follow the safety suggestions below!

Spring is here and with the season’s change comes the rain. It seems that we have had a good deal of precipitation just over the last two weeks in our region – and if you are looking at our local rivers and streams, we are noticing that the water is running fast and high. Floods happen everywhere – they are not relegated to specific regions like tornadoes or hurricanes. Our area has certainly had more than a few years over this last decade where flooding has been severe. For safety, please keep an ear out for warnings and follow the safety suggestions below!

Knowing when and when not to file an insurance claim is one of the tricks of the trade for someone trying to manage the costs of damage to one’s property or house. Every insurance agency has different regulations for what makes a valid claim, as well as for what policy modifications are necessary after a claim has been made. Often, insurance rates are raised. Based on the circumstances of the claim and of a homeowner’s claim history, policies can even be cancelled and a client can earn a reputation in the field that makes other providers refuse them or offer unaffordable policies. Therefore, it is helpful to know generally when and when NOT to file a claim for property damage.

Knowing when and when not to file an insurance claim is one of the tricks of the trade for someone trying to manage the costs of damage to one’s property or house. Every insurance agency has different regulations for what makes a valid claim, as well as for what policy modifications are necessary after a claim has been made. Often, insurance rates are raised. Based on the circumstances of the claim and of a homeowner’s claim history, policies can even be cancelled and a client can earn a reputation in the field that makes other providers refuse them or offer unaffordable policies. Therefore, it is helpful to know generally when and when NOT to file a claim for property damage.  The Fall Season has officially arrived in our area with the first frost (last night) and the cooler temperatures means that it’s time to start using our fireplaces and wood-burning stoves to help warm a room or to take a bit of the chill out of the air. Before you begin to use these, however, it is recommended to inspect and clean them to make sure they are safe to operate. According to the National Fire Protection Association, this should be done at least once a year, usually in the fall months.

The Fall Season has officially arrived in our area with the first frost (last night) and the cooler temperatures means that it’s time to start using our fireplaces and wood-burning stoves to help warm a room or to take a bit of the chill out of the air. Before you begin to use these, however, it is recommended to inspect and clean them to make sure they are safe to operate. According to the National Fire Protection Association, this should be done at least once a year, usually in the fall months. In addition to annual maintenance, we encourage our families, friends, and clients to always use safe fireplace practices:

In addition to annual maintenance, we encourage our families, friends, and clients to always use safe fireplace practices: Just because you have an older home doesn’t mean you can’t make it into a smart home. Many new home constructions are integrating smart home technologies into design, but even if you have an older home, there are systems you can implement in your home to manage systems that address security, locks, lighting, and heating/cooling. Making your home a “smart home” can help save energy, time and expense and you might be surprised to find that installing some of these smart features can be affordable and can be done yourself!

Just because you have an older home doesn’t mean you can’t make it into a smart home. Many new home constructions are integrating smart home technologies into design, but even if you have an older home, there are systems you can implement in your home to manage systems that address security, locks, lighting, and heating/cooling. Making your home a “smart home” can help save energy, time and expense and you might be surprised to find that installing some of these smart features can be affordable and can be done yourself! August is typically the hottest month of the year here in the Central New York region, and perhaps the only month that we struggle with trying to keep our homes a bit cooler. In many cases it doesn’t make sense to install air conditioning for the short period of time that it might be needed. Considering the small window of time that they are used, air conditioners can significantly increase your electricity costs. If you find yourself on a budget but still needing to make your home more comfortable during the heat of the season, these ideas may be helpful to you!

August is typically the hottest month of the year here in the Central New York region, and perhaps the only month that we struggle with trying to keep our homes a bit cooler. In many cases it doesn’t make sense to install air conditioning for the short period of time that it might be needed. Considering the small window of time that they are used, air conditioners can significantly increase your electricity costs. If you find yourself on a budget but still needing to make your home more comfortable during the heat of the season, these ideas may be helpful to you! Outdoor fire pits have become an increasingly popular outdoor home accessory. If you have a fire pit or are considering adding one to your yard, here are a few things you should think about for safety.

Outdoor fire pits have become an increasingly popular outdoor home accessory. If you have a fire pit or are considering adding one to your yard, here are a few things you should think about for safety. Spring is a great time of year to look around your home and decide on areas that could use a good refresh. Many homeowners keep a list of projects that they would like to do – now is the time to start crossing a few of those off your list! If you don’t have a list, but want to make some updates before the summer months, here are a few ideas for some outdoor and indoor projects. Some of these will depend on the amount of time and money you have to spend.

Spring is a great time of year to look around your home and decide on areas that could use a good refresh. Many homeowners keep a list of projects that they would like to do – now is the time to start crossing a few of those off your list! If you don’t have a list, but want to make some updates before the summer months, here are a few ideas for some outdoor and indoor projects. Some of these will depend on the amount of time and money you have to spend.