While buying a new house is certainly one of the most exciting things anyone can do, the actual process of getting into that house is often full of stress and hard work. Even when the sale has finally closed, you still have an incredibly daunting task ahead of you: moving. Some people choose to do it themselves; others hire professional help. Either way, it’s important to consider your valuable possessions, and what might happen to them during the move. No matter how careful you are, there’s always the risk that something bad can happen to these irreplaceable keepsakes. This is why it’s important to consider moving insurance.

While buying a new house is certainly one of the most exciting things anyone can do, the actual process of getting into that house is often full of stress and hard work. Even when the sale has finally closed, you still have an incredibly daunting task ahead of you: moving. Some people choose to do it themselves; others hire professional help. Either way, it’s important to consider your valuable possessions, and what might happen to them during the move. No matter how careful you are, there’s always the risk that something bad can happen to these irreplaceable keepsakes. This is why it’s important to consider moving insurance.

What is moving insurance?

Just like it sounds, moving insurance is insurance that is specifically designed to protect you from loss during the process of moving from one home to another. It is a short-term policy that covers the cost of these items should they be stolen, broken or lost during the move. As stressful as this time can be, the peace of mind that comes from knowing your valuables are protected is often worth as much, if not more, than the items themselves.

Moving company guarantees

But wait, you might ask – don’t moving companies guarantee the items they move? The answer to that question isn’t easy. In theory, a moving company guarantees your items against negligence. This is called “valuation,” and it’s a moving company’s version of insurance (although, it should be noted that for legal purposes they aren’t allowed to call it that).

Most basic moving company contracts will provide some form of valuation, and you can actually upgrade the valuation for more protection. However, this is not always fool-proof. In some cases, the valuation has a limit to the amount of protection offered. This means that more expensive items, such as antiques, heirlooms and large pieces of furniture, might not be covered under the terms of the valuation contract.

In addition, it’s not unusual for companies to try and wiggle out of paying by claiming that events were outside of their control – if you packed some boxes yourself, for example, they could try and claim that it was your faulty packing that led to the damage.

Existing insurance coverage

You might also wonder if your existing home insurance covers this move. Again, it’s a good question that doesn’t have an easy answer, because in truth it depends on the policy and its coverage. It’s safe to assume that it doesn’t cover it, however, since most homeowner policies only cover things while they exist inside the home. Once an item leaves the home, the coverage usually no longer applies. It’s a good idea to contact your insurance company and nail down specifically what is and isn’t covered during a move under your existing policy.

Purchasing moving insurance

So, even though we’ve seen that the moving company and your existing policy might offer some protection, it’s a safe bet that it isn’t enough coverage for the life you’ve built up over the years. This is where moving insurance comes in. This type of insurance is built specifically to cover items while they are being packed up in one place, transported across town, across the country or even internationally and unpacked in a new location.

Even better, most moving insurance policies last for a while, and cover damage of any kind, no matter what. So, if your items are in transit, but have to sit in one place for whatever reason, they’re still covered. If an earthquake happens to damage your items during the move, they’re covered.

In addition, many moving insurance policies also cover internal damage to electronics and appliances. So, even if the item in question looks completely fine, if it doesn’t work properly once it reaches its final destination, it’s possible to file a claim to get the item replaced.

Of course, different types of moving insurance plans can cover different sorts of items, events and amounts, but in general this sort of coverage provides you with the satisfaction of knowing that you’re covered, even if unforeseeable problems occur during the move.

Contact us today

If you are looking at a move in your near future, you’re probably stressed out enough as it is. You owe it to yourself to purchase the peace of mind that comes from moving insurance, and we are ready to help you. Please contact us at Bieritz Insurance today so our team can help assess your needs and come up with a plan of protection for you and your valuables. We look forward to hearing from you!

![]()

When embarking on home improvement projects, one of the first decisions is whether to do it yourself or to hire a professional. If you feel you have the skillset to undertake a particular project, then it might make sense to proceed with it. If you are not sure, remember that time is valuable – and if you make a mistake, you may likely have to do all the work over again or possibly end up calling a professional anyway. Make sure you consider your ‘worst case scenario’ and let that help guide you in your decision.

When embarking on home improvement projects, one of the first decisions is whether to do it yourself or to hire a professional. If you feel you have the skillset to undertake a particular project, then it might make sense to proceed with it. If you are not sure, remember that time is valuable – and if you make a mistake, you may likely have to do all the work over again or possibly end up calling a professional anyway. Make sure you consider your ‘worst case scenario’ and let that help guide you in your decision. The summer months are ones we look forward to all year long, but they bring certain risks along with the great summer weather. After our long, cold, winter months, we are all more than ready to be outdoors and enjoying fun times with family and friends. To minimize your risks, you can do a quick insurance protection check to make sure you are ready for the summer months.

The summer months are ones we look forward to all year long, but they bring certain risks along with the great summer weather. After our long, cold, winter months, we are all more than ready to be outdoors and enjoying fun times with family and friends. To minimize your risks, you can do a quick insurance protection check to make sure you are ready for the summer months. Outdoor recreation activities over the past few years (since the onset of COVID-19) has boomed with people throughout the U.S. looking for safe spaces with fresh air and good opportunities for socially distanced recreation. Here in New York, there are parts of the Catskills that were inundated with so many people, trails were closed in order to protect them from foot traffic. This surge in interest in outdoor activities has also spurred increased visitation at National Parks throughout the country. Those numbers continued to increase in 2021 – with close to 300 million visits and record high numbers in forty-four parks.

Outdoor recreation activities over the past few years (since the onset of COVID-19) has boomed with people throughout the U.S. looking for safe spaces with fresh air and good opportunities for socially distanced recreation. Here in New York, there are parts of the Catskills that were inundated with so many people, trails were closed in order to protect them from foot traffic. This surge in interest in outdoor activities has also spurred increased visitation at National Parks throughout the country. Those numbers continued to increase in 2021 – with close to 300 million visits and record high numbers in forty-four parks. Living in a classic old house is a privilege. Older homes can evoke a sense of beauty, love, charisma. They have a level of character and craftsmanship that are no longer seen in todays modern houses. However, during the cold winters, an older home can be quite uncomfortable. If you are looking into insulation, you may find the information here to be helpful.

Living in a classic old house is a privilege. Older homes can evoke a sense of beauty, love, charisma. They have a level of character and craftsmanship that are no longer seen in todays modern houses. However, during the cold winters, an older home can be quite uncomfortable. If you are looking into insulation, you may find the information here to be helpful.  Most people know that there are some logical ways to save money on their insurance. Bundling your auto and homeowners insurance with one carrier and agency can qualify you for a discount. You can use higher deductibles or drop some of your coverage levels. You can take driving safety courses or install security systems. These are all things that you can control and adjust as you need to. What you might not realize is that insurance pricing changes on a regular basis and is driven by many different factors. The general recommendation is to re-quote on your policies every 6-12 months.

Most people know that there are some logical ways to save money on their insurance. Bundling your auto and homeowners insurance with one carrier and agency can qualify you for a discount. You can use higher deductibles or drop some of your coverage levels. You can take driving safety courses or install security systems. These are all things that you can control and adjust as you need to. What you might not realize is that insurance pricing changes on a regular basis and is driven by many different factors. The general recommendation is to re-quote on your policies every 6-12 months. New York State is making a huge push to help homeowners and businesses transition out of fossil fuel dependence. Through

New York State is making a huge push to help homeowners and businesses transition out of fossil fuel dependence. Through  It’s the time of year when our snow-loving neighbors venture forth on wintery trails throughout our region. According to the International Snowmobile Manufacturers Association, in 2021, there were over 1.3 billion snowmobiles registered in the U.S. – over 100,000 of these are in New York State. New York offers thousands of miles of snowmobile trails that wind their way through some of the most beautiful and scenic parts of the state including the Catskill Mountains and the Adirondacks.

It’s the time of year when our snow-loving neighbors venture forth on wintery trails throughout our region. According to the International Snowmobile Manufacturers Association, in 2021, there were over 1.3 billion snowmobiles registered in the U.S. – over 100,000 of these are in New York State. New York offers thousands of miles of snowmobile trails that wind their way through some of the most beautiful and scenic parts of the state including the Catskill Mountains and the Adirondacks. The transition from one year to the next is often a time of reflection about our lives. We assess the things that we might like to change to make our lives a bit better, feel happier, healthier and more productive. Just as we make assessment of our personal habits, we can assess our surroundings as well. The new year allows us the opportunity to step back and reflect on ways we can make our households run more efficiently – maybe with some re-organization, or updates, repairs and improvements to our home in ways that make sense for our budgets and our future.

The transition from one year to the next is often a time of reflection about our lives. We assess the things that we might like to change to make our lives a bit better, feel happier, healthier and more productive. Just as we make assessment of our personal habits, we can assess our surroundings as well. The new year allows us the opportunity to step back and reflect on ways we can make our households run more efficiently – maybe with some re-organization, or updates, repairs and improvements to our home in ways that make sense for our budgets and our future.

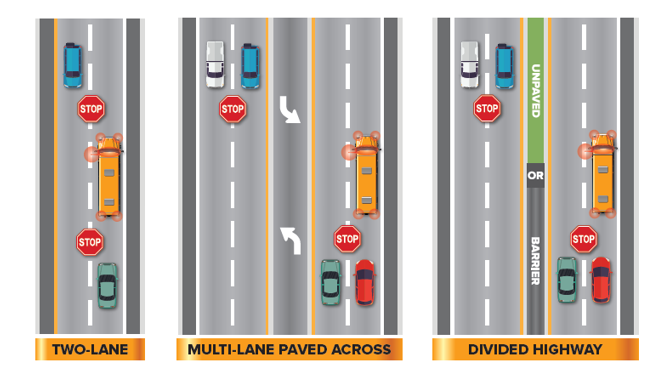

There is nothing more important than the safety of our children in getting back and forth to school. Whether they are walking, riding a bike or traveling in a school bus, it is imperative for drivers to be constantly aware, patient and exercise caution. Take a look through the following information for a refresher on School Bus Rules of the Road.

There is nothing more important than the safety of our children in getting back and forth to school. Whether they are walking, riding a bike or traveling in a school bus, it is imperative for drivers to be constantly aware, patient and exercise caution. Take a look through the following information for a refresher on School Bus Rules of the Road.

One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics.

One of the most important things we can tell our clients is to think about insurance before you actually have a need for it. If there is one thing we have all learned over this past year, it is that life can be unpredictable. While it may be hard to imagine the kinds of things that can happen that upend our lives, there are some systematic ways to assess some of the basics. One of the best things about summer is the ability to cook outdoors. We hold family barbecues, attend outdoor picnics, and just generally cook outside whenever we can while the season is here. 70% of our households in the U.S. own an outdoor grill or smoker. While a big part of our summer fare, outdoor cooking does not come without risks. An average of 10,600 home fires are caused each year and almost 20,000 emergency room visits are directly related to home grilling and about half of those injuries involve thermal burns. Take a look through these Summer Grilling Safety Tips – recommended by

One of the best things about summer is the ability to cook outdoors. We hold family barbecues, attend outdoor picnics, and just generally cook outside whenever we can while the season is here. 70% of our households in the U.S. own an outdoor grill or smoker. While a big part of our summer fare, outdoor cooking does not come without risks. An average of 10,600 home fires are caused each year and almost 20,000 emergency room visits are directly related to home grilling and about half of those injuries involve thermal burns. Take a look through these Summer Grilling Safety Tips – recommended by

Last week, we celebrated the 51st anniversary of the first Earth Day. The first event in 1970 looked a lot different than it does today. It was the largest single-day protest in human history when more than 20 million people poured out onto the streets throughout the US. Shortly after that, in 1972 landmark conservation laws and regulations were passed that included the Clean Water Act, the Endangered Species Act, the Marine Protection, Research and Sanctuaries Act, the Marine Mammal Protection Act, to name a few. While there is a lot that has changed over the last 50 years, a good deal of our original challenges that remain today. For example, Recycling remains a challenge. In Otsego County, only about 12% of recyclable materials are recovered with close to 80% continuing to go to landfills.

Last week, we celebrated the 51st anniversary of the first Earth Day. The first event in 1970 looked a lot different than it does today. It was the largest single-day protest in human history when more than 20 million people poured out onto the streets throughout the US. Shortly after that, in 1972 landmark conservation laws and regulations were passed that included the Clean Water Act, the Endangered Species Act, the Marine Protection, Research and Sanctuaries Act, the Marine Mammal Protection Act, to name a few. While there is a lot that has changed over the last 50 years, a good deal of our original challenges that remain today. For example, Recycling remains a challenge. In Otsego County, only about 12% of recyclable materials are recovered with close to 80% continuing to go to landfills. While buying a new house is certainly one of the most exciting things anyone can do, the actual process of getting into that house is often full of stress and hard work. Even when the sale has finally closed, you still have an incredibly daunting task ahead of you: moving. Some people choose to do it themselves; others hire professional help. Either way, it’s important to consider your valuable possessions, and what might happen to them during the move. No matter how careful you are, there’s always the risk that something bad can happen to these irreplaceable keepsakes. This is why it’s important to consider moving insurance.

While buying a new house is certainly one of the most exciting things anyone can do, the actual process of getting into that house is often full of stress and hard work. Even when the sale has finally closed, you still have an incredibly daunting task ahead of you: moving. Some people choose to do it themselves; others hire professional help. Either way, it’s important to consider your valuable possessions, and what might happen to them during the move. No matter how careful you are, there’s always the risk that something bad can happen to these irreplaceable keepsakes. This is why it’s important to consider moving insurance. Parking lots contain a lot of potential safety hazards for both pedestrians and drivers. The National Safety Council (NHS) states that

Parking lots contain a lot of potential safety hazards for both pedestrians and drivers. The National Safety Council (NHS) states that